12 22, 2025

{{ content.title }}

{{ content.description }}

On December 17, 2025, PJM Interconnection released the results of its Base Residual Auction (BRA) for the 2027/2028 delivery year, which runs from June 1, 2027 through May 31, 2028. This auction plays a critical role in shaping PJM’s future electricity mix across its wide footprint – covering 13 Mid-Atlantic states and Washington, D.C. – by ensuring the PJM grid has sufficient resources to meet forecasted demand, with a cushion to ensure reliability.

Just as importantly, the auction establishes a capacity clearing price. This price determines how much money demand response participants earn through PJM’s Emergency Load Response Program (ELRP) and directly impacts the capacity portion of electricity bills for ratepayers throughout the region.

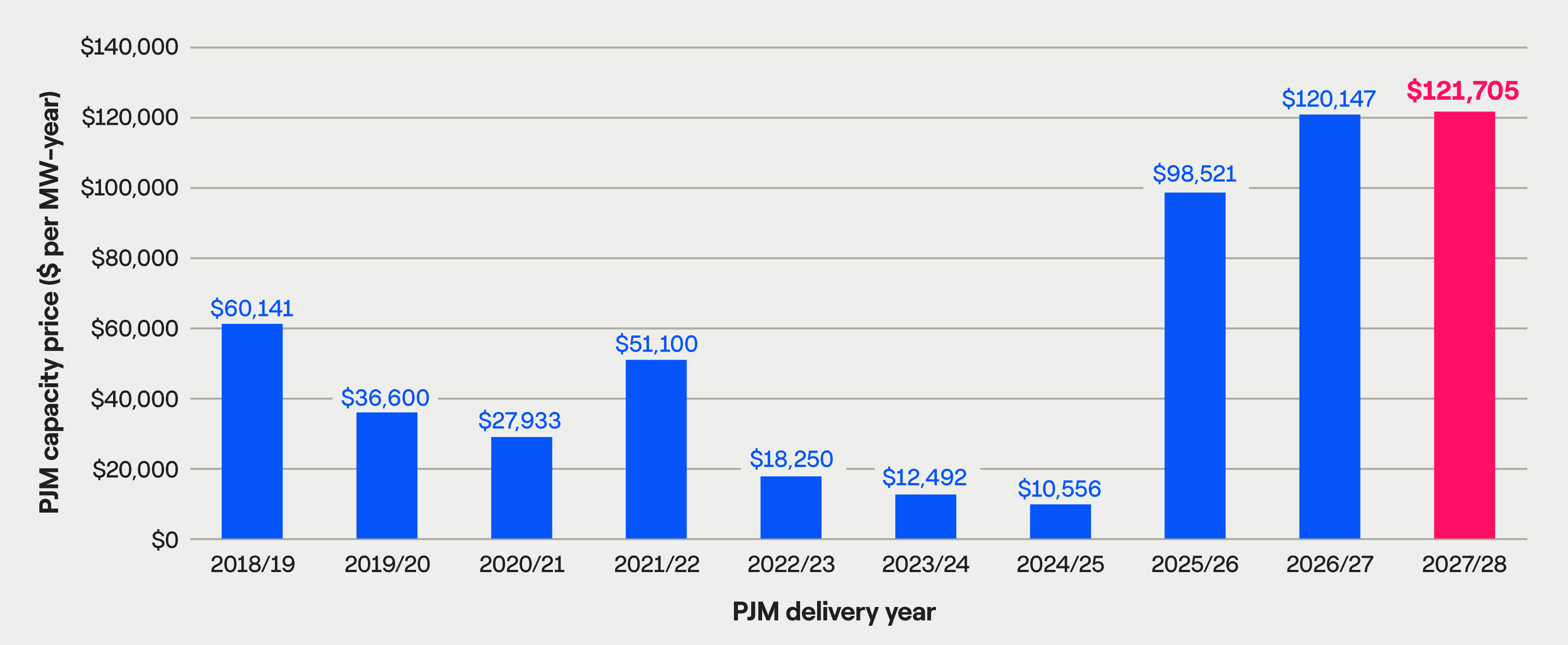

The 2027/2028 auction results were published right upon the heels of the 2026/2027 auction results in July, as PJM works through a condensed timeline to return to its three-year-forward auction schedule. With prices hitting the cap in July’s auction – and capacity costs and demand response pricing climbing for a second consecutive year – the results of the 2027/2028 auction were highly anticipated. Would prices again clear at the auction price cap?

What’s new in the 2027/2028 Base Residual Auction?

The most notable update in this auction is an adjustment to resource-specific Effective Load Carrying Capability (ELCC) ratings, first introduced in the 2025/2026 auction. PJM’s ELCC framework values all capacity resources based on how much they contribute to grid reliability, ensuring each resource is valued according to its expected performance during critical system conditions.

Over the past two auctions, ELCC ratings declined for many resources. Demand response was no exception, with ratings falling from 77% to 69% year over year. In the 2027/2028 auction, demand response ELCC ratings rebounded sharply – rising to 92%. This increase in valuation reflects successful advocacy from Enel North America and other industry stakeholders.

What does this mean for demand response participants? Simply put, they can now earn nearly the full value of the capacity they provide to the PJM grid.

A second notable update is a modest increase to the FERC-approved price cap and floor. First implemented in the 2026/2027 auction, the cap/floor framework was designed to protect ratepayers from extreme price volatility, encourage new generation development, and provide more predictable and solid returns for demand response participants.

For the 2027/2028 auction, the floor price increased from $64,693/MW-year to $65,535/MW-year, while the cap rose from $120,147/MW-year to $121,705/MW-year. As in the 2026/2027 auction, the price cap once again played a critical role – preventing another sharp price spike while maintaining strong market signals that PJM is facing a reliability crisis.

The results of the 2027/2028 Base Residual Auction

For the third consecutive year, capacity prices are rising across the entire PJM region, once again clearing at the price cap. The result: a capacity price of $121,705/MW-year throughout PJM.

PJM capacity prices climb for a third straight year in the 2027/2028 auction

Source: PJM Interconnection

While ratepayers won’t experience the dramatic bill shocks seen in the past two auctions, this outcome still marks a third straight year of elevated capacity costs. In other words, the cost of doing business remains high and shows little sign of easing.

At the same time, these sustained price levels only strengthen the value proposition for demand response. With capacity costs staying elevated – and demand response pricing remaining at record highs – participating in demand response has become an effective way for large energy users to offset rising charges and transform operational flexibility into meaningful revenue.

Without the cap, pricing would have been 60% higher

PJM estimates that without the price cap and floor, the auction would have cleared at $193,907/MW-year – 60% higher than the capped result. Once again, the cap proved its value by shielding ratepayers from a far steeper increase in capacity costs.

The cap/floor framework was designed as a temporary measure for the 2026/2027 and 2027/2028 auctions. As it stands today, PJM’s next capacity auction, scheduled for July 2026, is not expected to include this construct – though many industry observers anticipate the cap could be reinstated.

At the same time, these uncapped price simulations highlight a deeper issue: a continued tightening of supply across PJM.

PJM didn’t secure enough capacity to meet reliability requirements

Ensuring resource adequacy through sufficient reserve margins has been an ongoing challenge for PJM over the past two auctions – and that trend continued in the 2027/2028 auction. Reserve margins are critical because they provide a buffer to ensure PJM has enough power available when it’s needed most, particularly during extreme weather events.

In this auction, PJM set a reserve margin target of 20%, which increased from the 19.1% target set in the prior auction. However, the reserve margin actually procured in the auction declined sharply – from 18.9% in the prior auction to just 14.8% this time around. This marks the lowest reserve margin PJM has ever recorded and puts grid reliability in serious risk.

This decline in reserve margin marks a three-year trend that began with the 2025/2026 auction. The primary driver has been rapidly growing load forecasts that are largely fueled by data center expansion. New supply simply cannot keep pace with new large loads. For the 2027/2028 delivery year, PJM is projecting a peak load roughly 5,250 MW higher than in 2026/2027, with data centers accounting for nearly the entirety of that increase.

That said, this outlook could improve in the months ahead. Upcoming incremental auctions, updated load forecasts, and ongoing discussions around how large loads – particularly data centers – are integrated into the PJM grid all could meaningfully reshape the region’s grid reliability outlook.

What resources cleared in the auction?

A total of 136,147.6 MW was offered into the 2027/2028 auction, with 134,478.1 MW ultimately clearing. Some may remember that load on the PJM grid surpassed 160,000 MW this summer.

This 134,478.1 MW value is the post-ELCC value that is meant to represent PJM’s estimation of what generation levels PJM can expect during a seasonally averaged worst-case grid scenario, which is less than the true installed supply capacity on the grid.

In the 2027/2028 auction, PJM is once again relying on a diverse portfolio of resources to support grid reliability. The cleared mix consisted of 43% natural gas, 21% nuclear, 20% coal, 5% demand response, 4% hydro, 2% wind, 2% oil, and 1% solar.

Most notably, all demand response capacity offered into the auction cleared. Changes to ELCC ratings played a significant role in the outcome. While the amount of demand response capacity offered remained relatively stable compared to the 2026/2027 auction, the increase in the resource’s ELCC rating – from 69% to 92% – translated into a substantial increase in cleared capacity. As a result, cleared demand response resources rose from 5,531 MW in the prior auction to 7,299 MW in the 2027/2028 auction.

The new demand response landscape in PJM

2025 marked a turning point for demand response in PJM. It solidified demand response as an essential component of grid reliability – one that PJM will rely on more than ever as reserve margins continue to tighten. Throughout summer 2025, PJM called on demand response at record levels to help navigate growing reliability challenges. In fact, PJM told FERC that demand response was “essential” to reducing load during events in June.

This shift underscores the rising value of fast-responding, flexible resources that don’t require steel in the ground. Demand response is proving its value as a critical reliability resource, capable of responding precisely when and where the grid needs it most. According to FERC Commissioner Judy Chang: “I see load flexibility as a key tool for grid operators to meet the challenges that we face.”

Looking ahead to the 2027/2028 delivery year, PJM is further expanding the role of demand response by transitioning it into a 24/7 resource – an evolution that coincides with the increase in ELCC ratings to 92% and further validates the criticality of flexible loads to PJM during this moment of sharply rising demand. Many other regions across North America have long relied on demand response as a round-the-clock reliability resource, so this isn’t a new concept.

Don’t leave your earnings to chance – there’s too much at risk now

With PJM’s reliability challenges unlikely to ease anytime soon, demand response will likely continue to be called upon more frequently, and participants must be prepared for this new reality. Yes, that means more events. But it also means significantly greater earning potential: a higher annual capacity revenue payment plus more opportunities to earn attractive energy payments by performing during demand response events.

With substantial dollars at stake for both the 2026/2027 and 2027/2028 delivery years, the opportunity is undeniable, and the bar has been raised.

Performance is now more critical than ever to capturing record demand response revenue and offsetting rising capacity costs. As a result, selecting the right demand response provider has never been more important. Proven performance, expertise, transparency, and long-term value should be at the core of your decision when choosing your provider – you need to look beyond just the revenue split.

That high revenue split might look attractive on paper, but when you look beyond the number, the best deal isn’t always the biggest split. And sometimes those too-good-to-be-true splits are actually teaser rates that don’t persist after the first year or two of a multi-year contract. The best deal is the one backed by real results, year after year. A generous cut means little if the rest of the deal costs you in inaccurate/inflated nominations, hidden fees, outdated technology, or a lack of expertise – all of which can erode your earnings and introduce unnecessary risk. In this new landscape, there’s too much at stake.

Your earnings are on the line. Don’t leave them to chance. Enel is a global leader in demand response, with nearly two decades of experience in the PJM market. We bring the expertise, technology, and operational insight needed to help you navigate this evolving demand response landscape successfully and compliantly – while tailoring participation to your specific operational needs and helping you capture every earning opportunity available.

Reach out to our team today to start the conversation and turn today’s market conditions into a revenue opportunity that strengthens your bottom line.