07 24, 2025

{{ content.title }}

{{ content.description }}

Looking for the 2027/2028 PJM Base Residual Auction results? Visit this blog.

On July 22, 2025, PJM Interconnection released the highly anticipated results of its Base Residual Auction (BRA) for the 2026/2027 delivery year, which runs from June 1, 2026, through May 31, 2027. PJM is the largest grid operator in the United States, with its territory spanning 13 states and Washington, D.C. (Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, and West Virginia).

This critical auction serves two primary purposes. First, it helps shape the future electricity mix for the PJM region while securing sufficient power supply to meet projected demand, with enough of a cushion to keep the grid comfortably reliable. Second, the auction establishes a capacity clearing price, which determines the compensation that demand response participants receive for enrolling in PJM’s Emergency Load Response Program (ELRP). These prices also directly influence the capacity portion of electricity bills for ratepayers across the region.

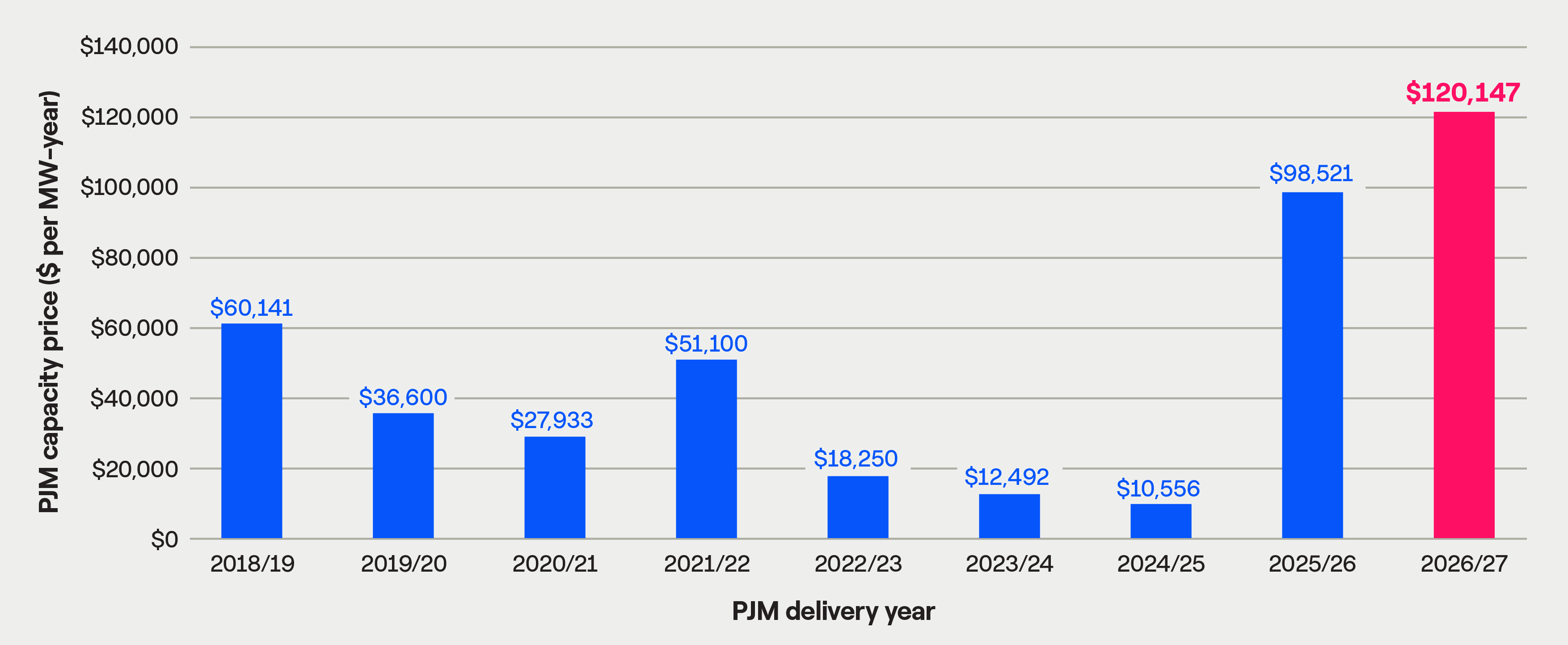

This year’s auction drew significant attention following the record-breaking outcomes of PJM’s 2025/2026 auction, where capacity prices surged to nearly ten times the previous auction’s levels. A combination of accelerated generator retirements, sharp demand growth, and evolving market rules around resource accreditation (Effective Load Carrying Capability, or ELCC) led to the tightest reserve margins in over a decade – triggering concerns over grid reliability and spurring calls for reform to protect consumers from pricing spikes.

In this blog, we’ll break down what changed in this year’s auction, the key results, what’s ahead for PJM, and how commercial and industrial (C&I) businesses can turn volatility into opportunity by leveraging demand response to earn revenue and manage rising energy costs.

First things first, what’s changed in the 2026/2027 Base Residual Auction?

Since the 2025/2026 auction results were announced in July 2024, governors, lawmakers, and consumer advocates expressed concerns around rising electricity bills for energy consumers across the region. To address Pennsylvania Governor Josh Shapiro’s complaint to the Federal Energy Regulatory Commission (FERC), PJM agreed to set a price floor and cap for the next two auctions.

For the 2026/2027 and 2027/2028 auctions, the floor price is $64,693/MW-year and is capped at $120,147/MW-year. The floor/cap structure accomplishes three things: it protects ratepayers from further unforeseen price hikes like we saw in the 2025/2026 auction, it provides certainty to generation developers to encourage them to build new generation, and it guarantees a solid return for flexible resources participating in the market (like demand response).

Another notable update in the 2026/2027 auction is an adjustment to resource-specific ELCC ratings, first introduced in the 2025/2026 auction. Most ELCC ratings declined from last year, with demand response dropping from 77% to an estimated 69%. Despite this reduction, the outcomes of the 2026/2027 auction still present a strong opportunity for increased revenue for demand response participants – mainly driven by another record-setting year of capacity prices.

The results of the 2026/2027 PJM Base Residual Auction

Many experts, including Enel North America, projected that PJM would hit FERC’s newly approved cap in the 2026/2027 auction. The high pricing in the 2025/2026 auction was not a fluke – PJM was signaling the need for investment in resources, and the results of the 2026/2027 auction signal a continued need for investment.

And that’s precisely what happened – capacity prices surged to the cap of $120,147/MW-year across the entire PJM region.

How does that stack up to the 2025/2026 auction? In that auction, the RTO cleared at $98,521/MW-year, with only the BGE and Dominion zones exceeding that mark, clearing at $170,218/MW-year and $162,155/MW-year, respectively.

Pricing soars to the highest possible level – and sets a new record – in PJM’s 2026/2027 capacity auction

Source: PJM Interconnection

What could have happened if PJM hadn’t implemented the cap?

It’s worth noting that PJM ran a simulation of the auction without applying the price cap and floor. The outcome? The market would have cleared at $141,828/MW-year – more than $20,000 higher than the actual capped result. While the cap ultimately shielded consumers from even steeper costs, it also highlights how constrained the market has become.

Supply and demand constraints are tighter than ever

PJM is forecasting peak load to increase from 154 GW to around 159 GW for the 2026/2027 delivery year, and ensuring resource adequacy is proving to be an ongoing challenge. In past years, PJM has secured capacity well above its reserve margin. Reserve margins serve as a buffer to ensure that there’s enough power available when needed, especially during extreme weather events. In the 2025/2026 auction, reserve margin shrank from 20.4% to 18.5% – the lowest in over ten years. PJM was only 0.7 percentage points above its reserve margin target of 17.8%.

The story is even more compelling in the 2026/2027 auction, with margins even tighter. While PJM procured more reserve margin than last year (18.9% compared to 18.5%), its reserve margin target increased from 17.8% to 19.1%. What does this mean? PJM came short of its reserve margin target by 0.2 percentage points – to put that into perspective, that’s a difference of just 309 MW.

This is what the new era of load growth looks like in the PJM region. It began with the 2025/2026 auction, and the story continues with the 2026/2027 auction. New loads (mainly from data centers) are proliferating, and new generation development cannot keep pace. With PJM continuing to operate with limited excess capacity, the value of fast-responding, flexible resources that don’t require steel in the ground – like demand response – continues to grow, playing an increasingly critical role in supporting system reliability.

What resources cleared in the auction?

Just over 135 GW of capacity was offered into the auction, with all but 800 MW clearing – highlighting PJM’s continued need for a diverse mix of resources to maintain grid reliability. Gas-fired generation made up 45% of the cleared capacity, followed by coal at 22%, nuclear at 21%, hydroelectric at 4%, wind at 3%, and solar at 1%.

Interestingly, the amount of demand response offered, approximately 8 GW, remained consistent with 2025/2026 auction levels. However, what’s notable is that 100% of those demand response resources cleared, underscoring their growing importance and reliability as a grid resource.

From valuation to availability, Enel continues to actively advocate for meaningful improvements to how demand response is treated in future auctions.

Enel’s advocacy is driving change as the program evolves for future auctions

Over the past year, Enel has collaborated with PJM and other market participants to address the concerning downward trend of demand response’s ELCC rating. ELCC is intended to reflect the likely availability of a resource type in the capacity market, and demand response resources can provide value year-round, 24/7 – and should be credited as such. As a result of these efforts, a compromise was reached, and PJM has filed with FERC to implement a rule change that significantly boosts demand response’s ELCC rating – from the preliminary value of 69% in the 2026/2027 delivery year to an estimated 92% for 2027/2028. This increase means participants will once again receive near-full value for each MW they contribute to the grid.

In exchange for this enhanced valuation, demand response resources will transition to a 24/7 availability model starting June 1, 2027. While this may sound like a significant shift, it’s already the standard in most other energy markets. And despite the 24/7 label, dispatches during overnight hours remain unlikely. Instead, we may see modest changes – such as earlier start times during frigid winter mornings or extended durations into the evening during periods of grid stress.

Starting in 2027/2028, the calculation behind ELRP’s winter baseline (WPL) will also change slightly to better align with hours of grid stress, resulting in a lower value than previous years. Enel’s analysis indicates that most customers should be able to maintain similar winter nominations to what they have today.

While these changes may seem complex, they don’t have to be. That’s why having a knowledgeable team by your side is essential. Enel’s team of demand response experts is here to help you make sense of evolving program requirements, navigate market shifts with confidence, and ensure your business is set up for successful participation. With Enel, you’re covered every step of the way.

These evolutions in ELCC and resource availability underscore the increasingly vital role demand response plays in supporting grid reliability and resilience across PJM. The next Base Residual Auction – for the 2027/2028 delivery year, when these changes are set to take effect – is scheduled for December 2025.

The new reality for demand response in PJM

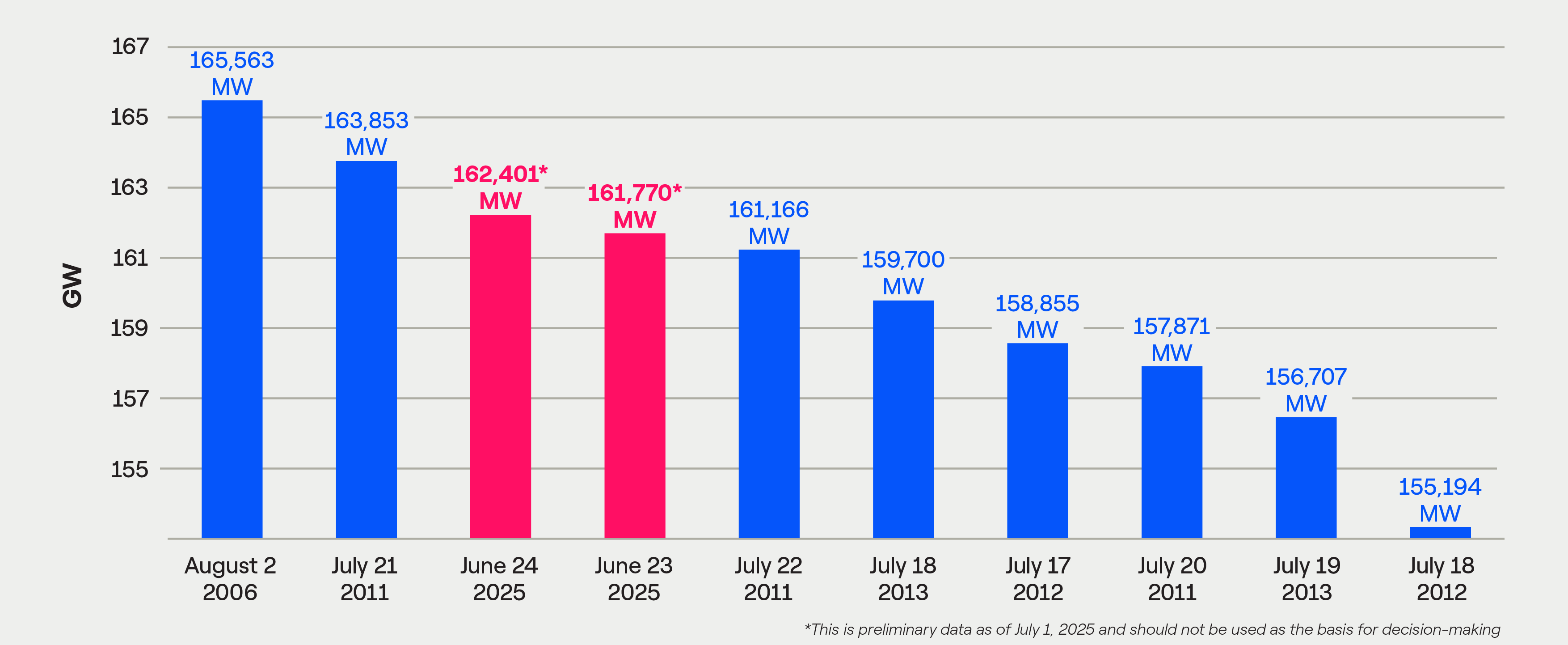

June’s record-breaking heatwave sent grid reliability shockwaves across the eastern half of the United States and Canada. PJM, in particular, was put to the test as it faced its most serious resource adequacy challenge since concerns were first raised following the 2025/2026 auction. From June 23 through June 25, the PJM grid experienced sustained strain as extreme heat drove electricity demand to unprecedented levels. During this time, it was all-hands-on-deck as PJM issued maximum generation alerts, requiring generators and transmission owners to delay scheduled maintenance and keep all available resources online.

On June 23 and June 24, PJM recorded its third and fourth highest peak electricity demand of all time – 161 GW and 162 GW, respectively – with both peaks surpassing PJM’s summer load forecast of 154 GW. Demand response played an essential role in ensuring grid stability in PJM during this period – without demand response, PJM’s 162 GW peak would have been higher. At the time of the peak, PJM had just 10 GW in reserve – an extraordinarily tight margin.

PJM top 10 summer peaks

Source: Maintaining Grid Reliability Through Highest Peaks in a Decade

This is no longer a drill. This is the new reality for demand response in the PJM region. Demand response is not about passing audits and being on standby. It’s about showing up when it counts. Emergency events like those faced in June are exactly what demand response was built for, and its importance to grid resilience has never been more evident. PJM reserves demand response for true times of grid strain – if you are being called for an event, you can be sure that the grid needs your contribution at that time.

What’s more, not all available demand response resources were deployed during these events, highlighting untapped potential that could have provided even greater relief. Demand response offers real, scalable grid support far faster and more flexibly than building new steel-in-the-ground generation. We will likely continue to see this trend persist as PJM faces reliability concerns, relies on flexible resources like demand response to reduce demand, and transitions demand response into a 24/7 resource.

With the results now published, what steps should you take?

With the auction results now published, the next step is enrollment. For C&I companies to participate in PJM’s demand response program for the 2026/2027 delivery year, they must first secure a spot in the market. As part of the Base Residual Auction, Enel has already committed a set amount of capacity (measured in MW), which we now look to fill with eligible C&I participants.

To reserve your place in Enel’s portfolio, it’s essential to connect with our team as soon as possible – available capacity is limited and in high demand.

As many demand response providers begin filling their portfolios, now is the time to ask the right questions – and choose a provider who delivers more than just a high revenue split. With demand response pricing this strong and emergency events likely to be called more frequently, choosing the right provider has never been more critical to help you unlock your facility’s potential, navigate future evolving program requirements, and execute successfully during events. Proven performance, market expertise, transparency, and long-term value should be at the core of your decision.

Your earnings are on the line – don’t leave them to chance. Choosing the wrong provider can cost you through inaccurate/inflated nominations, hidden fees that cut into your revenue, outdated technology, or a lack of market and industry expertise.

Here are a few key questions to ask potential providers:

How long have you been in the PJM market?

Are you leveraging the highest available capacity prices and ELCC values in your payment calculation?

Do you charge any hidden fees, such as metering costs or performance penalties?

Is the energy reduction plan you are recommending realistic for our operations?

What visibility and tools will we have to track and manage our dispatch performance in real-time, ensuring we are maximizing our earnings?

Do you have a dedicated customer support team? How will you help us set ourselves up for success?

As the global leader in demand response, Enel can help you navigate these questions and more, ensuring you make an informed decision with confidence. Partner with a demand response provider who puts your success first – contact our team today.