08 16, 2024

{{ content.title }}

{{ content.description }}

Looking for the 2026/2027 PJM Base Residual Auction results? Visit this blog.

On July 30, 2024, PJM Interconnection unveiled the outcomes of their capacity auction for the 2025/26 delivery year, which will begin in June 2025 and end in May 2026. Known as the Base Residual Auction (BRA), this auction is typically held three years before the delivery year. It shapes the PJM region’s electricity mix and ensures there is enough power supply to meet electricity demand. PJM is the largest power grid in the United States – they operate across 13 states, plus Washington, DC: Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and the District of Columbia.

Our team has been eagerly awaiting the results of the 2025/26 BRA, originally scheduled for May 2022 but then suspended as the Federal Energy Regulatory Commission (FERC) considered approving new capacity market rules brought forth by PJM. In July, PJM finally held the auction and capacity pricing significantly increased from the previous auction. This means customers in PJM can generally expect to see higher capacity charges on their bills, but it also opens up a significant opportunity to offset those price increases by participating in demand response.

This blog shares our key takeaways from the auction and how your organization can take advantage of this landmark opportunity in PJM. You’ll learn what the 2025/26 BRA results mean for organizations like yours that may already be participating in demand response, have maybe been sitting out on the sidelines until this moment, or are new to demand response and are considering participating in the future.

Here’s a sneak peek at the potential: the value in the U.S.’s largest energy market is so attractive that your organization would be leaving significant money on the table by not participating in demand response. The financial gains are not just attractive – they’re compelling.

The results of the 2025/26 PJM BRA

The BRA results for the 2025/26 delivery year have shattered all expectations, surpassing even the most optimistic forecasts by market analysts. The pricing increase for demand response in this auction is staggering. This is a monumental shift in the PJM region, a breath of fresh air after years of declining pricing.

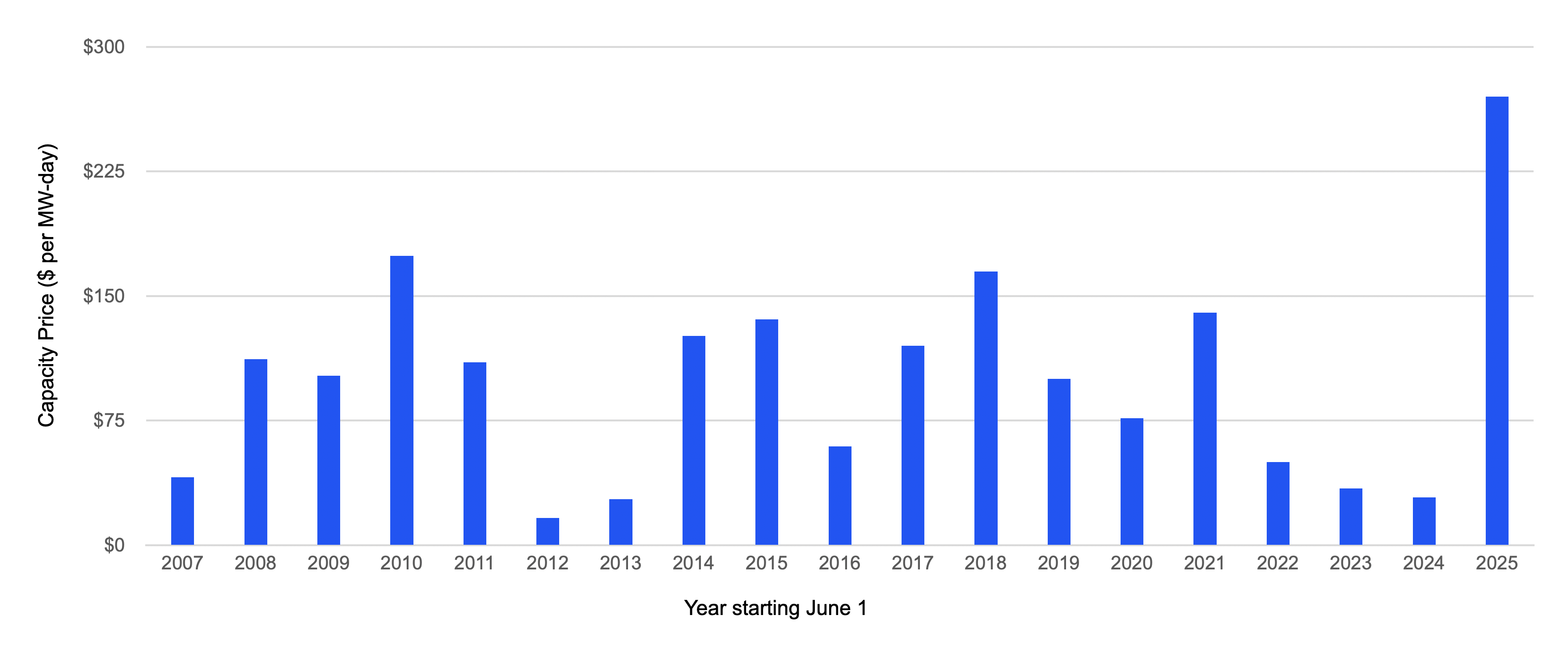

In this auction, pricing across most of PJM ‘cleared’ at $269.92 per MW-day, which translates to $98,520.80 per MW-year. ‘Clearing’ in this context means that the auction successfully matched the supply of electricity with the demand, and the price at which this matching occurred is the ‘clearing price.’ This price is the highest that the market has ever cleared and is almost ten times the price of the current year.

2025/26 BRA in PJM – demand response pricing skyrockets to record levels

Source: PJM Interconnection LLC. This chart excludes Baltimore Gas & Electric (BGE) and Dominion (DOM), where pricing jumped to the zonal cap.

It’s important to note that two zones cleared just short of their reserve requirement and are transmission-constrained zones, causing prices to jump to the zonal cap:

- Baltimore Gas & Electric (BGE) in Maryland – pricing soared to $466.35/MW-day ($170,217.75/MW-year)

- Dominion (DOM) in Virginia and North Carolina – pricing soared to $444.26/MW-day ($162,154.90/MW-year)

Our team pulled together a 2024/25 BRA $/MW-year pricing report across PJM zones and compared it to the 2025/26 BRA results, so you can easily see the increase between these two years.

PJM zone | 2024/25 (current year) | 2025/26 (next year) | % increase |

Atlantic City Electric Company (ACE) | $20,056.75 | $98,520.80 | 391.21% |

American Electric Power Co. Inc. (AEP) | $10,555.80 | $98,520.80 | 833.33% |

Allegheny Power (AP) | $10,555.80 | $98,520.80 | 833.33% |

American Transmission Systems, Inc (ATSI) | $10,555.80 | $98,520.80 | 833.33% |

Baltimore Gas and Electric Company (BGE) | $26,645.00 | $170,217.75 | 538.84% |

Commonwealth Edison Company (ComEd) | $10,555.80 | $98,520.80 | 833.33% |

The Dayton Power and Light co. (DAY) | $10,555.80 | $98,520.80 | 833.33% |

Duke Energy Ohio Kentucky (DEOK) | $35,127.60 | $98,520.80 | 180.47% |

Duquesne Light Company (DLCO) | $10,555.80 | $98,520.80 | 833.33% |

Dominion Virginia Power (DOM) | $10,555.80 | $162,154.90 | 1436.17% |

Del Marva Power and Light Company (DPL) | $20,056.75 | $98,520.80 | 391.21% |

Del Marva Power and Light Company South (DPL South) | $33,083.60 | $98,520.80 | 197.79% |

Jersey Central Power and Light Company (JCPL) | $20,056.75 | $98,520.80 | 391.21% |

Metropolitan Edison Company (Met-Ed) | $18,063.85 | $98,520.80 | 445.40% |

PECO Energy Company (PECO) | $20,056.75 | $98,520.80 | 391.21% |

Pennsylvania Electric Company (Penelec) | $18,063.85 | $98,520.80 | 445.40% |

Potomac Electric Power Company (Pepco) | $18,063.85 | $98,520.80 | 445.40% |

PPL Electric Utilities Corporation (PPL) | $18,063.85 | $98,520.80 | 445.40% |

Public Service Electric and Gas Company (PSE&G) | $20,056.75 | $98,520.80 | 391.21% |

Public Service Electric and Gas Company (PSE&G) North | $20,056.75 | $98,520.80 | 391.21% |

Rockland Electric Company (RECO) | $20,056.75 | $98,520.80 | 391.21% |

Pricing is $/MW-year

The auction cleared a diverse mix of resources, with demand response comprising 5% of the resource mix and clearing around 6,000 MW of capacity. In total, the auction cleared 135,684 MW worth of capacity.

Resource | % of the resource mix |

Gas | 48% |

Nuclear | 21% |

Coal | 18% |

Demand response | 5% |

Hydro | 4% |

Solar | 1% |

Wind | 1% |

Other | 2% |

What factors led to these results?

Several factors have contributed to the sharp pricing increase in the 2025/26 BRA results. A wave of generating resource retirements and forecasted demand increases have resulted in the tightest supply/demand balance in years. In addition, PJM implemented FERC-approved market design changes around risk modeling and resource accreditation, further reducing capacity. These factors combined to cause reserve margins to shrink from 20.4% to 18.5% – the lowest margin in over ten years. Of course, this raises reliability concerns and the need for PJM to invest in generation.

Let’s dive into these factors.

1. Generator retirements

PJM is facing an almost 6,600 MW decrease in installed capacity as generators are either retiring or signaling that they will retire. Unfortunately, generation assets are retiring faster than replacement capacity can be built, creating a gap in supply along with reliability concerns.

Electric grids need a diverse set of flexible resources to ensure reliability. However, the generation assets required to replace these retired plants, such as new wind and solar projects, are facing extensive delays in PJM’s interconnection queue. The need for new generating capacity is not just important – it’s urgent. PJM is actively looking for ways to speed up the interconnection process to bring new generating capacity online in 2024 and 2025.

2. Surging demand

The 2025/26 BRA results have signaled that supply needs to catch up with demand growth. Electricity demand is expected to grow across the region, driven by data center development, domestic manufacturing growth, electrification, and extreme weather. PJM has forecasted a peak load of 153,883 MW for the 2025/26 delivery year, an increase of 3,243 MW from 2024/25.

This trend may be a recurring theme in future auctions, as PJM’s long-term forecast predicts significant growth over the next 15 years.

3. Market reforms, including changes in resource accreditation

The 2025/26 BRA marks a change in how PJM models reliability risks during extreme weather and matches them with resource accreditation. PJM uses their Effective Load-Carrying Capability (ELCC) framework to accredit all resources and value how these resources contribute to grid reliability. In the previous BRAs, PJM leveraged an average ELCC, which valued the contribution of a whole resource class. In addition, accreditation was limited to a small number of resources.

However, for the 2025/26 BRA – and this is the reason for the auction delay – FERC approved changes to PJM’s accreditation to more accurately value every resource’s contribution by switching to a marginal framework. This framework values the contribution of the incremental resource in a technology class (instead of the whole resource class, as was done in the past). Marginal ELCC relies on hourly modeling of probability to calculate the likelihood a resource type will be available when called upon to support the grid.

This change to marginal accreditation also impacted the amount of supply that could be offered in the 2025/26 BRA. While this BRA cleared 135,684 MW of capacity, the 2024/25 BRA cleared 13,252 MW more – 148,946 MW. This reduction is the result of several resource classes, including demand response, experiencing reduced accreditation. Demand response, in particular, experienced a ~25% derate, meaning that an organization participating in demand response would now receive compensation for a forecasted 76% of their capacity performance. The pricing per MW does not change; it is just the value of that MW.

Despite the lower accreditation for resources like demand response, the spike in capacity pricing in the 2025/26 BRA still results in very favorable outcomes for market participants. For example, organizations participating in demand response will still receive around five times more revenue than they would in the current program year.

Is this the new norm in PJM?

At this point, it is not easy to say. PJM introduced many new rules for the 2025/26 auction. We are seeing the effects of a drastically different landscape in PJM from when the last auction took place in December 2022. That was right before Winter Storm Elliott, where demand response played an essential role in maintaining grid continuity when traditional generation and transmission equipment failed in freezing temperatures.

However, we may soon find out what the future holds. Given that the 2025/26 BRA was delayed, PJM is now on a compressed auction schedule to get back on track with a three-year forward schedule. The next auction (for the 2026/27 delivery year) is scheduled for December 2024. It is expected that reserve constraints will continue to be tight in the next few years, causing prices to remain elevated.

Enel North America remains one of the loudest voices in PJM’s ear to advocate for demand response to continue to play a critical role in the PJM capacity market to support a more flexible grid and a cleaner energy future. Our team will continue to advocate for favorable rules. Demand response remains a cost-effective, quick-to-implement resource that can support grid stability as an alternative to physical power plants, which require significant investments and lengthy wait times in interconnection queues.

What steps should your organization take now?

The 2025/26 PJM BRA outcomes have created the most favorable environment for demand response participants in decades. If your organization is currently participating, thank you for contributing to grid stability – more good things will come next year. If you’ve been sitting out for the past few years as pricing slumped – now is the time to get back in the game. And if your organization is beginning to learn about the benefits of demand response (have you checked out our demand response 101?), there is no better time to kick off your journey and enroll for the next program year.

Whichever scenario from above you fall into, one essential fact remains – ensuring you work with an experienced demand response partner has never been more crucial. A partner should understand the challenges that your industry faces, tailor an energy reduction strategy specific to your priorities, be transparent about your earning potential, and demonstrate the experience required to help you maximize opportunity.

As the global leader in demand response, Enel has the resources to help you drive value from demand response programs in the PJM region, with personalized energy reduction plans, deep market expertise, and a team by your side every step of the way, with your organization’s best interests at heart. We have partnered with organizations like yours in PJM since 2006 and have a portfolio of more than 3,000 customers in the region.

Contact our team today to learn more about participating in demand response in PJM and how you can stake your claim on this landmark opportunity to earn some serious revenue.