05 14, 2025

{{ content.title }}

{{ content.description }}

On Monday, April 28, 2025, the Midcontinent Independent System Operator (MISO) released the results of their Planning Resource Auction (PRA) for the 2025/2026 planning year. MISO is the grid operator responsible for operating the grid and wholesale power markets across 15 U.S. states and the Canadian province of Manitoba – and delivering reliable power to 45 million energy users.

The 2025/2026 PRA results reveal a mixed picture for grid reliability across MISO’s multi-state footprint. While capacity remains sufficient to meet projected electricity demand, warning signs are flashing for the summer months, underscoring the need for continued investment in capacity resources to meet growing demand. This year’s auction results are also noteworthy because they reflect the first application of MISO’s new Reliability-Based Demand Curve (RBDC) framework.

In this blog, we dive into the auction results, the factors that drove them, and our key takeaways. We’ll also explain how businesses in the MISO region can monetize their energy flexibility, mitigate the impact of rising capacity costs, and support grid reliability with demand response participation, which is increasingly becoming an essential grid reliability tool for MISO.

Why the PRA matters

The PRA is MISO’s annual auction to secure enough power supply resources to meet forecasted electricity demand for the next planning year, in this case, June 1, 2025 – May 31, 2026. Market participants – including utilities and power generators – buy and sell capacity to ensure the grid can withstand peak periods, especially during high-demand seasons like summer and winter.

The purpose of the PRA is to avoid any last-minute capacity shortfalls. Because MISO is comprised largely of vertically integrated and regulated utilities, most of these Load Serving Entities (LSEs) have already self-supplied or secured the capacity they need by the time the PRA is held. LSEs work with state regulators years in advance and outside the auction process to make long-term capacity planning decisions to meet their electricity obligations to their customers.

Those LSEs that cannot meet their resource adequacy requirements enter the auction to procure capacity to meet their shortfall. And that’s where the PRA comes into play.

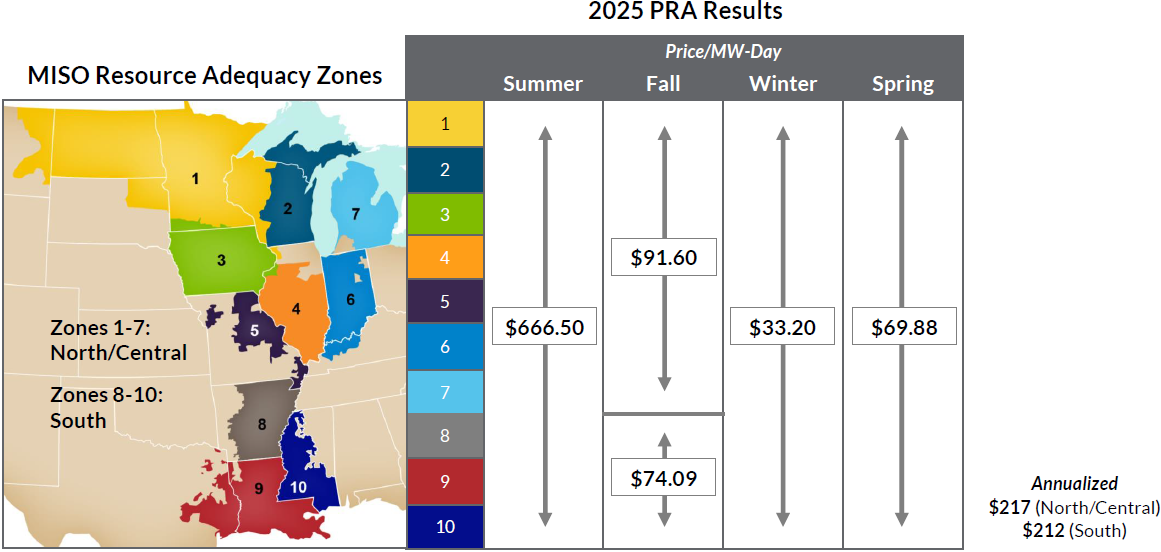

2025/2026 MISO PRA seasonal clearing prices

While MISO cleared sufficient resources to meet their requirements, price signals vary dramatically across seasons. Overall, prices for the 2025/2026 year cleared 10x higher than last year’s 2024/2025 PRA, with Missouri’s (Zone 5) fall and spring seasons being the only exception. However, the standout figure is the summer capacity price of $666.50 per MW-day, which cleared uniformly across all MISO zones and is 22x higher than last year.

Summer season (June, July, August)

Pricing is $666.50/MW-day across all zones.

Compared to the 2024/2025 PRA: This pricing is a massive increase from $30/MW-day last year.

Fall season (September, October, November)

Pricing is $91.60/MW-day in the North/Central subregion and $74.09/MW-day in the South subregion.

Compared to the 2024/2025 PRA: This pricing is a big jump from $15/MW-day across all zones last year (apart from Missouri, which had cleared at $719.81/MW-day).

Winter season (December, January, February)

Pricing is $33.20/MW-day across all zones.

Compared to the 2024/2025 PRA: This pricing increased from $0.75/MW-day last year across all zones.

Spring season (March, April, May)

Pricing is $69.88/MW-day across all zones.

Compared to the 2024/2025 PRA: Pricing doubled from $34.10/MW-day across all zones last year (apart from Missouri, which had cleared at $719.81/MW-day).

Annualized average

$217/MW-day for the North/Central subregion

$212/MW-day for the South subregion

Factors driving the summer price spike

Several interrelated factors are contributing to the elevated summer price. Let’s dig into them a bit.

Declining reserve margins

What we are witnessing is similar to what PJM experienced in the 2025/2026 PJM Base Residual Auction, with surplus capacity – the extra cushion beyond what’s needed to meet forecasted demand – declining to record lows, resulting in reliability concerns. It’s important to note that MISO does have enough capacity, but they are uncomfortably close to their Planning Reserve Margin target.

MISO’s 2025/2026 surplus dropped 43% compared to last summer, despite a slightly lower Planning Reserve Margin target (7.9% for 2025/2026 compared to 9.0% for 2024/2025), continuing a steady decline year over year: 6.5 GW in 2023, 4.6 GW in 2024, and 2.6 GW in 2025. Why does this matter? Declining reserve margins reduce MISO’s flexibility to handle unexpected demand spikes or generation outages.

Power plant suspensions and retirements

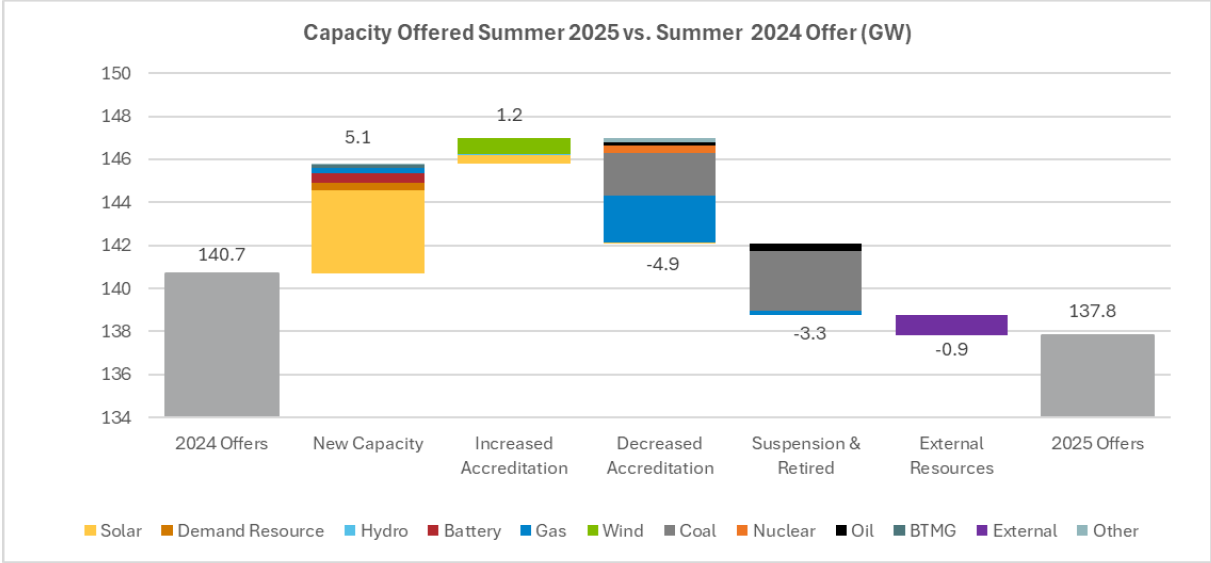

Similar to the 2024/2025 PRA, coal and natural gas power plants continue to face retirement or suspension. 3.3 GW in retirements and suspensions are slated for the 2025/2026 planning year. Unfortunately, this amount was not replaced with new generation assets coming online due to various factors, one of them being reduced accreditation.

Reduced accreditation of certain resources

Reduced accreditation is offsetting a large percentage of the new capacity coming online for the 2025/2026 planning year. 5.1 GW of new capacity (primarily solar, batteries, demand response, and gas) and 1.2 GW in increased accreditation is being offset by 4.9 GW in reduced accreditation (primarily for gas, coal, and nuclear).

Chipping away at available capacity

You can see how the above factors worked together to reduce available capacity offered in summer 2025 in the waterfall chart below:

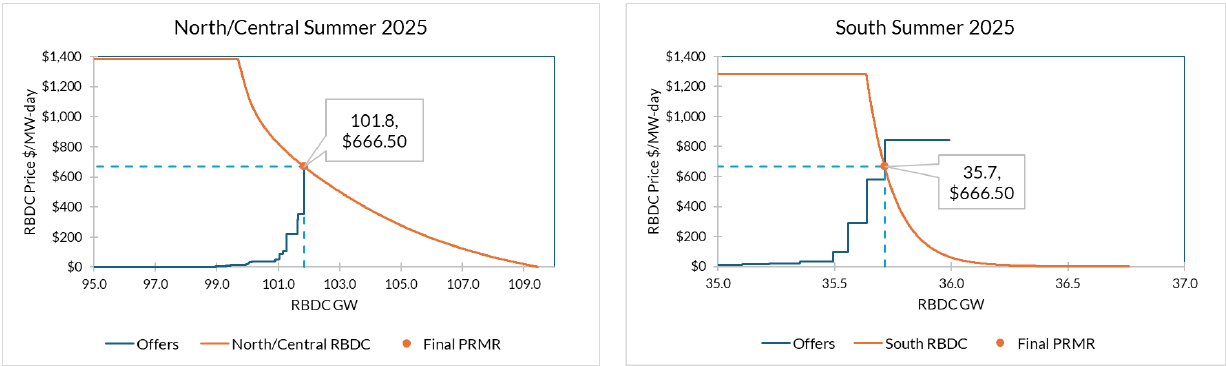

Understanding the new Reliability-Based Demand Curve (RBDC)

Another factor contributing to higher prices in summer was the implementation of the RBDC – a market design enhancement proposed by MISO and approved by the Federal Energy Regulatory Commission (FERC) to better align capacity prices with grid reliability.

Historically, MISO pricing has been of a boom-and-bust nature due to a vertical demand curve. Under this model, very little value was ascribed to any capacity surplus relative to requirements. Pricing is divorced from the marginal value of capacity needs; the price is set close to zero when the market has capacity and then spikes with any shortage. You can see this represented in the chart below:

MISO’s intent with the new RBDC framework is to deliver pricing that better reflects the value of capacity and resource adequacy risk across seasons. Instead of a vertical demand curve, the RBDC introduces a downward-sloping curve that reflects increasing value as reserve capacity shrinks, especially during seasons when the grid is more vulnerable – like summer. The RBDC aims to stabilize prices in non-summer seasons, avoiding the extreme volatility we’ve seen in past years, and provides transparent value for capacity that exceeds the Planning Reserve Margin target.

As you can see in the charts below, the new RBDC directly ties capacity prices to reliability value. As summer is a riskier season for MISO, prices rise sharply as the grid nears its minimum required reserve level:

MISO’s key intended benefits of the RBDC:

More accurate reliability signals: Send clear and stable investment signals across the grid to encourage greater capacity investments.

Seasonal price differentiation: Enhanced ability to reflect seasonal reliability risk, particularly as extreme weather events become more frequent

Stabilized market outcomes: Reduced volatility in non-summer seasons, avoiding the boom-and-bust nature seen in the past.

A growing trend: MISO needs more demand response resources

Following the results of the 2025/2026 PRA, it’s clear that MISO is actively encouraging the development of new capacity resources – such as demand response – to help meet rising demand and ensure they have enough resources. This is a critical need, as new large energy loads from manufacturing facilities, data centers, and further electrification efforts are expected to surge, putting additional pressure on the grid.

Over the past decade, the MISO footprint has experienced a significant shift in its resource mix, with sharp declines in fossil and nuclear generation and a surge in renewables and flexible resources. Although conventional generation still makes up most of MISO’s capacity, renewable resources like wind and solar continue to gain ground. In the 2025/2026 PRA, approximately 9.1 GW of solar and 6 GW of wind cleared – up from 4.9 GW and 5.2 GW, respectively, just a year earlier. While this evolving resource mix is good news for the energy transition, it has created complexity on the supply side of the supply-demand equation.

That’s where demand response comes into play. Demand response unlocks flexibility on the demand side, enabling the grid to reduce demand to meet available supply during critical moments – such as renewable intermittency or sudden spikes in demand – to avoid disruption. Instead of relying solely on expensive steel-in-the-ground power plants that can take years to build, the grid has a solution at their fingertips right now: dynamically and cost-efficiently manage energy on the demand side.

As a result, demand response has an expanding role in maintaining grid reliability. Demand response in MISO has grown considerably over recent years. 9 GW of demand response resources cleared in the 2025/2026 auction, up from 8.1 GW from just last year. And since the 2016/2017 planning year, demand response has increased 42%.

The MISO 2025/2026 PRA results are a call for businesses to make extra money while helping the grid

The 2025/2026 PRA results – high summer clearing prices and tightening reserve margins – point to a grid operating with significantly less buffer than in years past and may lead to higher electricity costs. These results serve as a clear call to action for businesses:: participate in demand response now to begin monetizing your business’ energy consumption.

You earn payments not just for every kW you can reduce during grid emergencies but also for your willingness to be on standby to help the grid – generating meaningful earnings to offset rising operating costs.

Where can businesses participate in demand response in MISO?

While demand response adoption is growing in MISO, most MISO states currently restrict Aggregators of Retail Customers (ARCs), like Enel North America, from direct market access. ARCs aggregate the demand response capabilities of multiple customers and offer that energy flexibility into the wholesale electricity markets. Direct market access is only permitted in Illinois, Michigan, and portions of Wisconsin and Missouri at this time. Enel North America participates in these MISO wholesale markets and also offers exclusive, bilateral utility programs with Ameren Illinois and Ameren Missouri.

Demand response provides significant value to the MISO grid, enhancing reliability and flexibility during peak demand periods. To help extend these benefits across the region, Enel is actively working with industry coalitions to advocate for expanded ARC access in additional MISO markets – including Iowa, Minnesota, and currently restricted areas of Wisconsin.

Enel helps you navigate MISO demand response markets with confidence

Partnering with a proven demand response leader like Enel North America is the key to unlocking real value. With personalized strategies, deep market expertise, and hands-on support, Enel helps you reduce energy costs, earn revenue, and boost resilience without added risk.

In a volatile business environment, demand response should be the opposite – predictable, rewarding, and low-hassle. Backed by 20+ years of experience and a global track record, Enel gives you confidence and clarity every step of the way. We help businesses like yours:

Identify and capture demand response opportunities

Maximize demand response revenue with full transparency

Navigate market complexity with expert guidance

Avoid demand response penalties through proven performance

Enel’s customer-first approach, advanced technology, and unmatched expertise make us the trusted partner for businesses ready to lead in a smarter energy future. Contact us today to get a conversation started with our team.