Are you feeling like energy prices are increasing and energy risk is growing? You are not alone. Rising energy prices and market volatility caused by geopolitical pressures have been fueling an escalating perception of energy risk. As a result, organizations have been enhancing their energy strategies. They are focusing on sustainable energy solutions that help stabilize their energy costs, boosting their energy resilience to economic uncertainty.

Lasting market turbulence results in a growing perception of energy risk

While still feeling the impact of the supply shortfall due to the COVID-19 pandemic, energy markets have been further shaken by geopolitical pressures stemming from Russia’s invasion of Ukraine. The conflict that started in February 2022 has impeded the flow of natural gas to Western Europe. The EU is highly dependent on Russia’s natural gas for heat and power, importing 83% of its natural gas in 2021, with 45% coming from Russia. Price volatility in Europe ricocheted globally, with prices skyrocketing in other countries – including the United States.

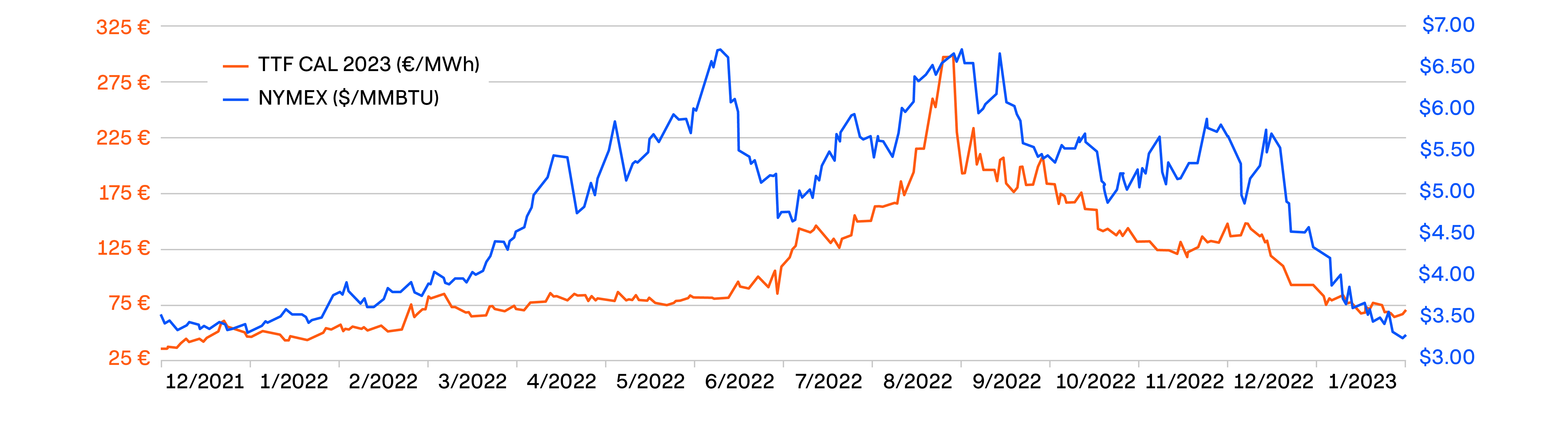

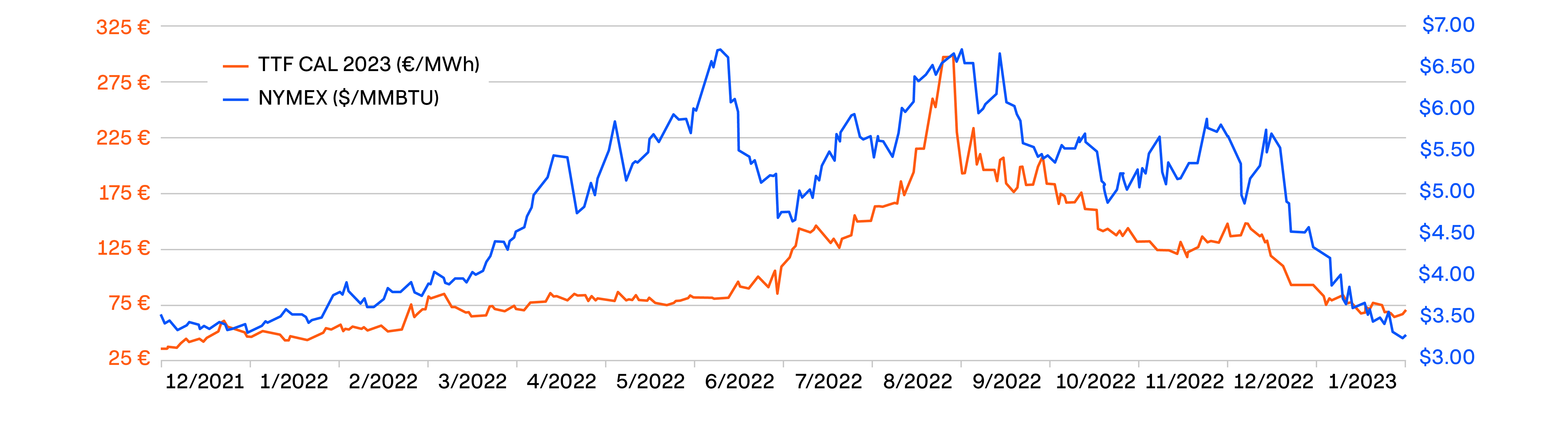

European natural gas price volatility impacting natural gas prices in the United States

2023 CAL TTF/Henry HUB

Our energy markets analysis demonstrates the link between natural gas price volatility in Europe and in the United States.

With the conflict still ongoing, how likely is that energy prices will stabilize? And what about the deteriorating economic conditions around the globe? A recession may lower natural gas demand in the United States, forcing prices to decline, but we expect continuing volatility and higher prices than in the pre-Russia-Ukraine war era to continue beyond 2023.

Price hikes, supply and demand unpredictability, and extreme volatility have been sowing uncertainty and a growing perception of energy risk. Experts like Enel’s CEO Francesco Starace are expecting the turbulence in energy markets to persist for some time. As a result, organizations are adjusting their energy strategies by investing in energy resilience and sustainability. Clean energy technologies are becoming more attractive to mitigate high fossil fuel energy costs and carbon emissions. Elevated prices are motivating consumers to switch from conventional cars to electric vehicles (EVs), resulting in higher demand for EVs and EV charging. In addition, more organizations are looking to power their operations with renewable energy by implementing on-site solutions that generate and store renewable energy.

There is a growing need for energy resilience and flexibility amid the volatility

Energy resilience is primarily thought of as ensuring energy continuity at times of grid supply disruption – but the energy landscape is now seeing disruption in all areas of energy strategy, and it’s crucial to be resilient to a variety of challenges. Keeping energy prices stable amid volatility is driving organizations to boost their resilience to economic uncertainty, what we call “economic resilience.” To learn more about incorporating energy resilience into your energy strategy, please read our eBook: How to Evaluate Your Energy Resilience Needs.

For instance, in some areas of the country, the energy transition is leading to significant changes in tariffs and pricing. This is especially true for organizations with high electricity needs at times of peak energy usage grid-wide. As a result, there is a rising demand for energy solutions that can help organizations stabilize their energy costs, such as energy storage and solar + storage systems.

Even after years of rapid growth, BloombergNEF predicts that the global energy storage market will grow 30% annually through 2030, with the world’s biggest storage market currently in the United States. These solutions deliver economic value by enabling organizations to shift their energy demand from times of highest cost to times of lowest cost to realize energy bill savings. But storage is not the only solution organizations use for economic resilience in their energy strategy.

This era of economic uncertainty has also led to more interest in virtual power purchase agreements (VPPAs) – another clean energy solution with the potential to protect organizations against pricing volatility. With VPPAs, organizations lock into 8- to 12-year agreements, insulating them from potential price increases over time with stable energy supply pricing. In addition, experienced clean energy suppliers help organizations structure deals that mitigate financial risk. This trend has given rise to new customized contract structures that go beyond basic power purchase agreements and offer hedging strategies.

What does this mean for organizations investing in clean energy and sustainability solutions?

Global energy volatility is one of the key trends shaping the energy landscape in 2023, and it has driven organizations to embed economic resilience into their energy strategies. As a result, organizations will increasingly invest in solutions that can help them stay resilient to economic changes, including energy storage and systems that pair both solar and storage on-site. Organizations will also look for energy partners who can provide customized power purchase agreements tailored to their specific appetite for risk.

To learn more about how volatility and other key energy trends will impact your organization’s energy strategy in the years ahead, read our eBook, Top 5 Energy Trends in 2023.