Inflation dominated news headlines in 2022, and one of the many drivers of the widespread price increases was climate change. While many people still believe that their lives are immune to climate change, its effects are already hitting the economy, businesses, and individual wallets. From food to energy, take a look at some of the ways climate change is making our lives and doing business more expensive – and learn what your organization can do about it.

Extreme weather events and atypical temperatures are causing more damage – and becoming most costly

Climate change is leading to more extreme weather events such as droughts, storms, and floods. Britain, France, and Spain had their hottest year on record, as 2022 wrapped up with an unusually warm winter in Europe. During the 2022 hurricane season in the United States, Hurricanes Ian, Nicole, and Fiona brought extensive damage to the Florida coast and Puerto Rico. In December, storms around the country hit harder than ever, and much of America faced heavy snow and below-freezing temperatures. Leading into 2023, California has gone from severe droughts and wildfires to epic floods.

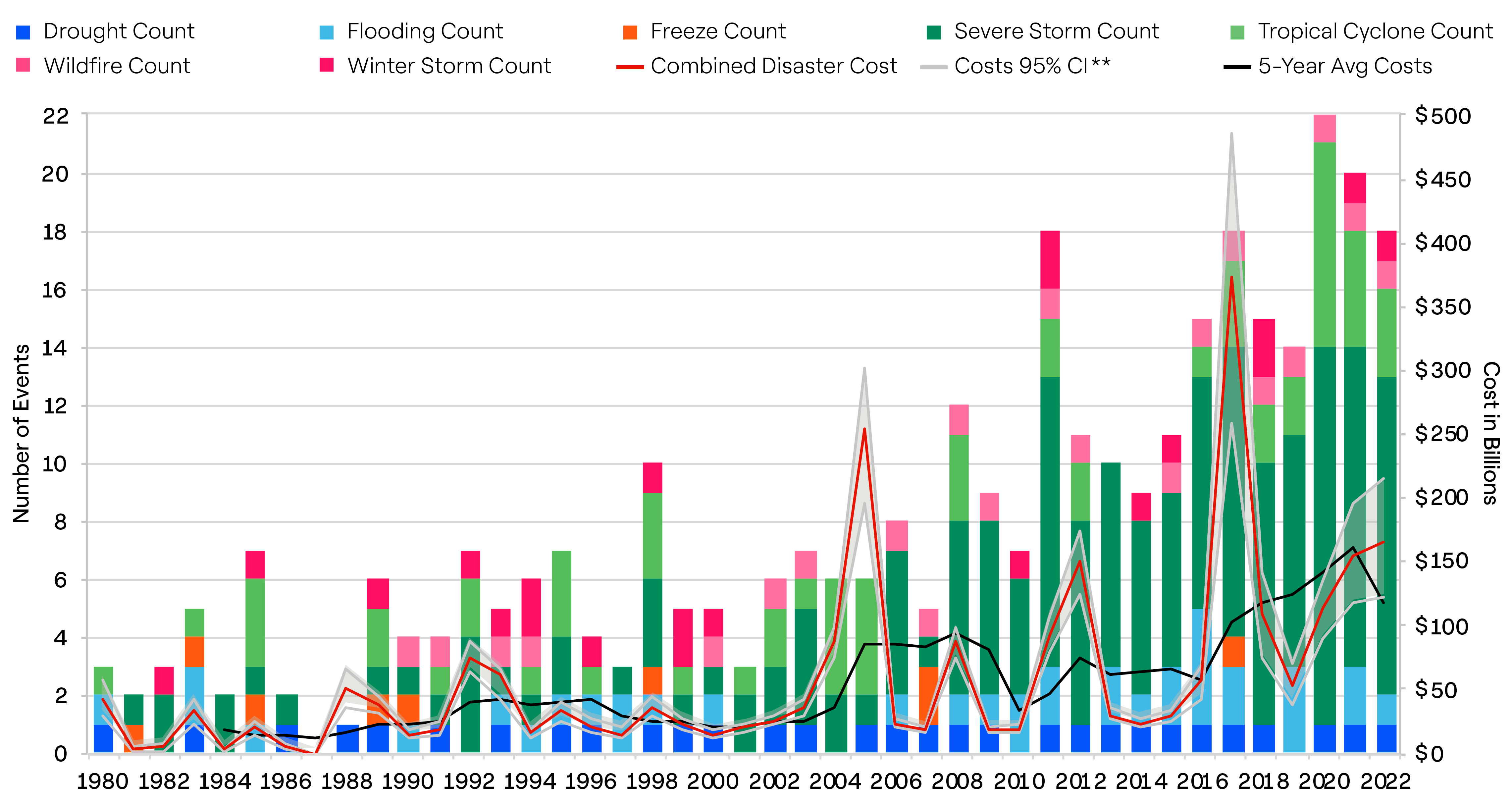

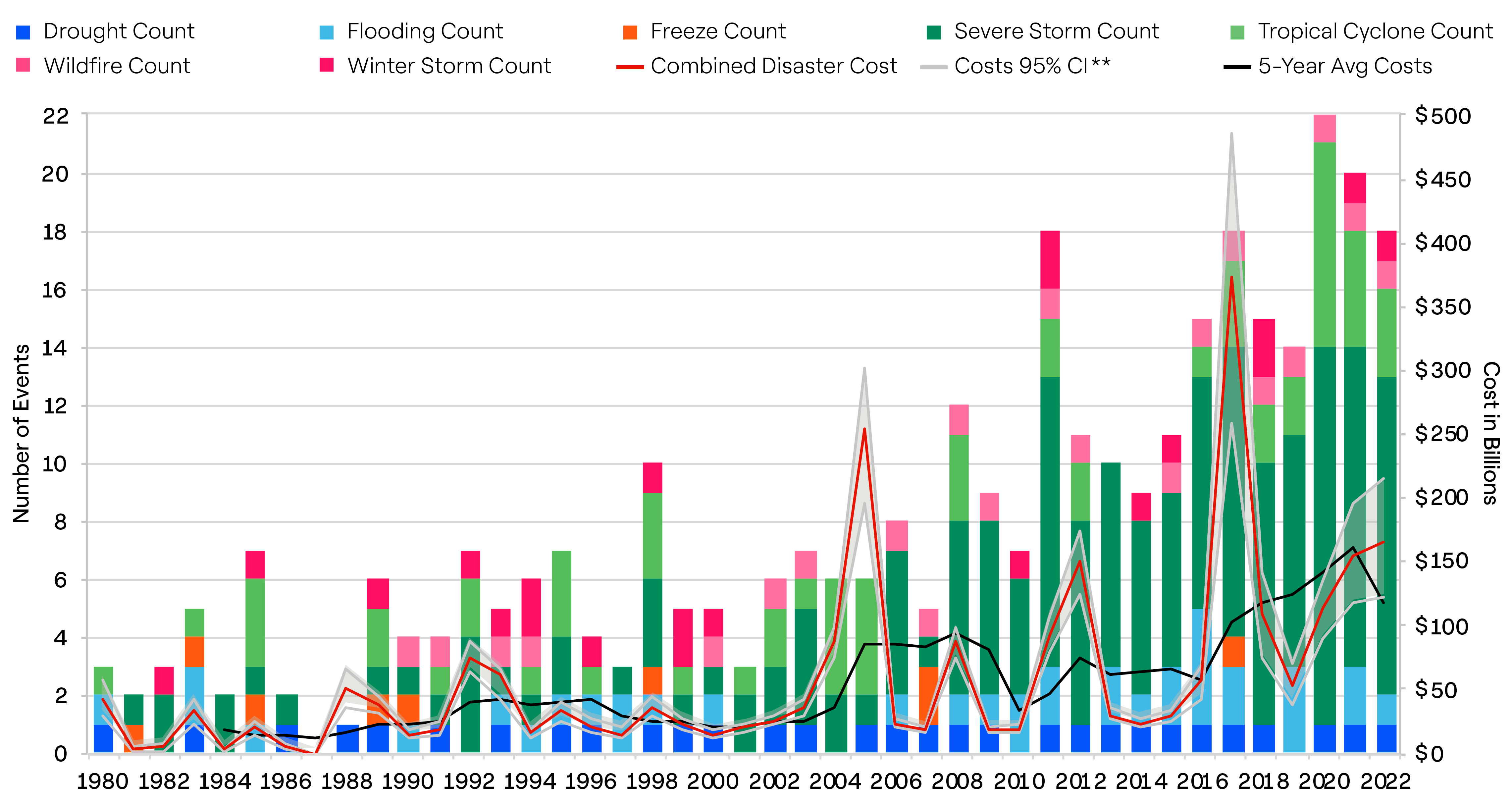

Extreme weather events like these inflict significant damage to infrastructure, leading to increased costs for both businesses and consumers. For example, there were 18 extreme weather events in the United States in 2022 that each resulted in losses of about $1 billion. These losses include physical damage to buildings and vehicles, roads and bridges, as well as businesses and people’s homes.

United States billion-dollar disaster events 1980-2022 (CPI-adjusted*)

* To reflect changes in costs over time due to inflation, this graphic also shows events with less than $1 billion in damages at the time of the event, but after adjusting for inflation (Consumer Price Index), now exceed $1 billion in damages.

** The 95% confidence interval (CI) probability is a representation of the uncertainty associated with the disaster cost estimates.

Graphic courtesy https://www.ncei.noaa.gov/access/billions/time-series

As insurers struggle to cover the costs of destruction caused by extreme weather events, they raise insurance premiums. Some states have seen premiums rising at more than double the rate of inflation. This, in turn, has led to higher costs for businesses and individuals and can be particularly challenging in areas prone to natural disasters, such as California or Florida.

But the price of climate change goes far beyond damage to infrastructure. It affects food prices through prolonged droughts, floods, and heatwaves that lead to lower crops yields and increased costs for farmers. In 2022, food prices went up in part due to “heatflation,” a term that describes the way unusually hot temperatures play a role in driving up food prices.” According to the U.S. Department of Agriculture, food prices rose by about 10% in 2022 and will continue growing at rates above historical averages in 2023.

There are countless notable examples of these increases – for instance, onions in the Philippines became three times as expensive as chicken after a series of super typhoons in the country. Similarly, the price of olive oil has been surging due to extreme temperatures in European countries like Italy and Portugal. And these trends will continue – a new report from the Environmental Defense Fund demonstrates how climate change will continue to slow the crop yield growth for some American staples like corn, soybeans and wheat by 2030.

Increased power interruptions and energy pricing volatility are building interest in energy resilience and flexibility

Erratic weather has become a critical threat to aging energy infrastructure in the United States and is challenging grid stability. Major power outage frequency increased 67% from 2000 to 2020 and is expected to rise further. Recent studies show that the grid will need 5-12% of additional power-generating capacity to meet increasing demand and reliability requirements. In addition to facing increased power outages, American companies saw their energy-related costs increase by $41.4 billion in 2022.

So, with extreme weather-induced sudden increases in power demand and disruptions in power supply becoming the new normal, compounded with high energy prices, organizations have been increasingly interested in both economic and operational energy resilience to address volatile energy costs while ensuring business continuity.

In some areas of the country, organizations are experiencing significant changes in tariffs and energy pricing. This is especially true for organizations with high electricity needs at times of peak energy usage grid-wide. As a result, there is a rising demand for energy solutions that can help organizations stabilize their energy costs, such as energy storage and solar + storage systems. BloombergNEF predicts that the global energy storage market will grow 30% annually to 2030, with the world’s largest storage market currently in the United States. Energy storage solutions deliver economic value by enabling organizations to shift their energy demand from times of highest cost to times of lowest cost to realize energy bill savings.

Energy storage is not the only solution organizations can leverage for economic resilience in their energy strategy. There has also been increasing interest in virtual power purchase agreements (VPPAs) – a clean energy solution with the potential to protect organizations against pricing volatility. With VPPAs, organizations lock into 8- to 12-year agreements, insulating them from potential price increases over time with stable energy supply pricing. In addition, experienced clean energy suppliers help organizations structure deals that mitigate financial risk. This trend has given rise to new customized contract structures and solutions beyond basic power purchase agreements.

Distributed energy resources like demand response (DR) play a key role in providing grid flexibility to help the grid remain in balance – which is important in preventing a grid outage. When there is grid instability, the grid operator or utility calls upon resources like DR participants to reduce their energy consumption. By participating in DR programs, organizations can earn lucrative payments for agreeing to reduce their energy use during times of electricity grid stress. DR program providers like Enel North America have seen an increase in DR events over the last few years. This trend continued in 2022 – Enel North America saw a record year for DR, with more than 700 events, totaling 5,530 hours and 38,063 MWh dispatched.

What does this mean for organizations investing in clean energy solutions?

The impact of climate change on prices and energy resilience is a key trend shaping the energy landscape in 2023. It is a major concern for organizations and as a result, they will increasingly focus on cutting costs and embedding sustainability and resilience into their energy strategies.

To respond to questions that some of our customers have, our experts at Enel North America published a new eBook that describes how the energy space will change going forward and what it means for your organization. Read our eBook, Top 5 Energy Trends in 2023, to learn how to future-proof your energy, procurement, and sustainability strategies.