By Maddie Lee

Maddie Lee is a Policy Analyst at Enel North America. She is responsible for facilitating the implementation of federal policies at Enel, such as the Inflation Reduction Act and the Infrastructure Investment and Jobs Act, across a wide range of technologies including renewable energy, green hydrogen, and EV charging infrastructure.

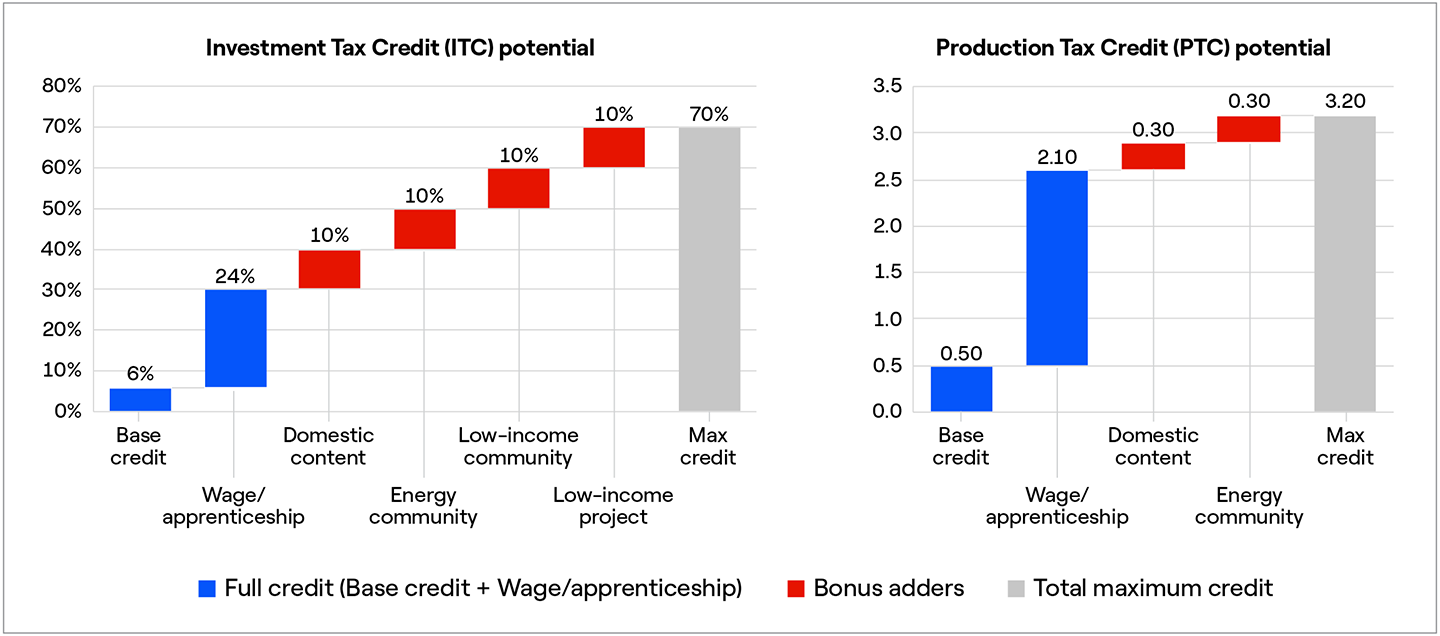

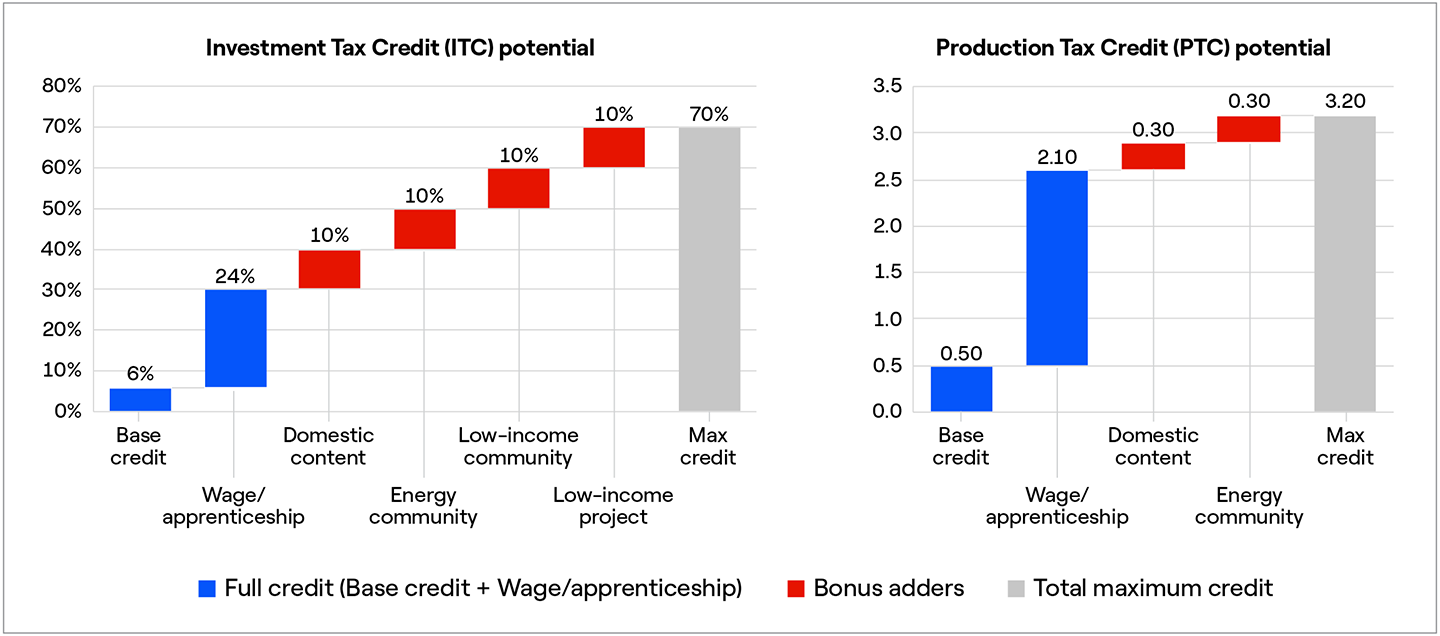

The Inflation Reduction Act of 2022 is an unprecedented, transformative piece of legislation that provides consistent support to accelerate the deployment of clean power over the next decade. For clean energy projects, the legislation’s available tax credits are structured in tiers, with a partial credit value, a full credit value when prevailing wage and apprenticeship requirements are met, and an opportunity to unlock bonus adders when specific conditions are met. There are various conditions organizations must meet to unlock the full value of a 30% Investment Tax Credit (ITC) or a 2.6 ¢/kWh Production Tax Credit (PTC) – read our overview of the Inflation Reduction Act to learn more. In this blog, we’re focusing on what we know to date around the bonus adders: what they are, how they work, and how projects can qualify for them.

As a global leader in the energy sector, Enel North America is driving the energy transition from fossil fuels to renewables. We also believe in ensuring a just energy transition that is accessible to all. While there is still much work to do, we applaud the inclusion of the bonus adders in the Inflation Reduction Act to support good-paying manufacturing jobs in the clean energy supply chain and drive growth in areas most impacted by the energy transition, including low-income communities and those in communities historically dependent on fossil fuel mining or extraction.

What are the Inflation Reduction Act’s bonus adder tax credits?

The Inflation Reduction Act of 2022 includes preliminary criteria for what these bonus adder tax credits entail – so let’s start with what we do know. The Inflation Reduction Act includes three bonus adders: the domestic content bonus, the energy communities bonus, and the low-income communities bonus.

The domestic content bonus adder tax credit is a 10% bonus adder awarded to facilities for which: (1) 100% of their steel or iron components is produced in the United States, and (2) 40% of their manufactured product components are produced in the United States. Learn the latest guidance regarding domestic content requirements.

The energy communities bonus adder tax credit is a 10% bonus adder for electricity produced incommunities most impacted by the energy transition. An energy community is defined as one of the below:

- Brownfield: A site where expansion, redevelopment, or reuse can be complicated by the presence (or potential presence) of a hazardous substance, pollutant, or contaminant.

- Fossil fuel employment: A metropolitan or non-metropolitan statistical area (MSA or non-MSA) that has (or had, at any time after 2009) 0.17% or greater direct employment or 25% or greater local tax revenues related to the extraction, processing, transport, or storage of coal, oil, or natural gas (as determined by the Treasury Secretary) – and has an unemployment rate at or above the national average for the previous year (as determined by the Treasury Secretary).

- Coal closure: A census tract containing a coal mine that has closed after December 31, 1999, or a coal plant that has retired after December 31, 2009, plus adjoining census tracts.

The low-income communities bonus adder tax credit is an ITC-only 10% bonus adder for wind, solar photovoltaics (PV), and energy storage (if combined with wind or solar PV projects) – with an eligible project size of less than 5 MW (AC) in size. If the project is in a low-income community or on tribal land, the bonus is 10%. If the project is part of a qualified low-income residential building or an economic benefit project, the bonus doubles to 20%. Because there will be a finite pool of tax credits available each year, applicants must apply and compete for an award.

It's important to note that each of these bonus adders affects the PTC/ITC differently. Qualifying projects built within these communities receive a 10% or more boost in tax credits. For the ITC, the boost is expressed in percentage points – a 10% increase means going from the full credit value of 30% to a total of 40%. For the PTC, the boost is expressed in percentage terms and is only applicable to energy communities – a 10% increase means going from the full credit value of 2.6¢/kWh to a total of 2.9¢/kWh (numbers shown in 2022 dollars and are current as of December 2022 – they will be adjusted annually for inflation). Figure 1 shows how these adders are stacked to achieve the potential maximum. Since an additional 10% or more boost in tax credits can make the difference between a project that makes economic sense and one that does not, it’s important to understand the eligibility requirements for capturing these bonus adders.

Figure 1: Achieving the potential maximum credit value

What have we learned from follow-up guidance?

The U.S. Department of the Treasury and the Internal Revenue Service (IRS) are releasing guidance on key provisions of the Inflation Reduction Act. Some of the guidance is specific to tax credits that incentivize investment in underserved and hard-hit fossil fuel communities. Below we provide a short description of what these specific notices contain as they relate to the application and implementation of the Inflation Reduction Act bonus adder tax credits.

In February 2023, the Treasury Department and the IRS issued guidance on the low-income communities bonus adder tax credit, clarifying the capacities available for 2023. The notice announced that the program will allocate 1.8 GW of capacity in 2023 across four categories for solar and wind projects with a 5 MW maximum output:

- 700 MW for facilities located in low-income communities

- 200 MW for facilities located on Tribal land

- 200 MW for facilities serving federally subsidized residential buildings

- 700 MW for facilities where at least 50% of the financial benefits of the electricity produced go to households with incomes below 200% of the poverty line or below 80% of area median gross income

Note, we are still waiting for the Treasury Department to offer details on the overall program design of the low-income communities bonus adder tax credit, such as when and how to apply for this specific tax credit. More information to come.

In April 2023, the Treasury Department and the IRS issued what is expected to be the first set of guidance for the energy communities bonus adder tax credit. The Treasury Department and the IRS also anticipate issuing proposed regulations that will apply to taxable years ending after April 4, 2023.

In the April notice, the guidance first clarified that to qualify for the energy communities’ “brownfield” category, a site must have the presence or potential presence of a hazardous substance, pollutant, or contaminant or be mine-scarred land, and – most importantly – the site must not be an excluded property as defined in 42 U.S.C. § 9601(39)(B). We want to flag this last requirement because there is a long list of brownfield site categories with confirmed contamination that are excluded from the energy communities “brownfield” category, so we recommend reviewing 42 U.S.C. § 9601(39)(B) very closely to confirm a site’s eligibility.

The guidance also described a “brownfields” safe harbor. A site will be considered an energy communities eligible “brownfield” site if it is not in one of the excluded categories (described above) and can meet at least one of the following three requirements:

- Federal, state, territory, or federally recognized Indian tribal brownfield resources previously assessed the site as a brownfield site

- An ASTM E1903 Phase II Environmental Site Assessment (“ESA”) confirms the presence of a hazardous substance, or a pollutant or contaminant on the site

- An ASTM E1527 Phase I ESA has been completed for projects with a nameplate capacity of 5MW (AC) or less (see below for further clarification in the June 2023 guidance)

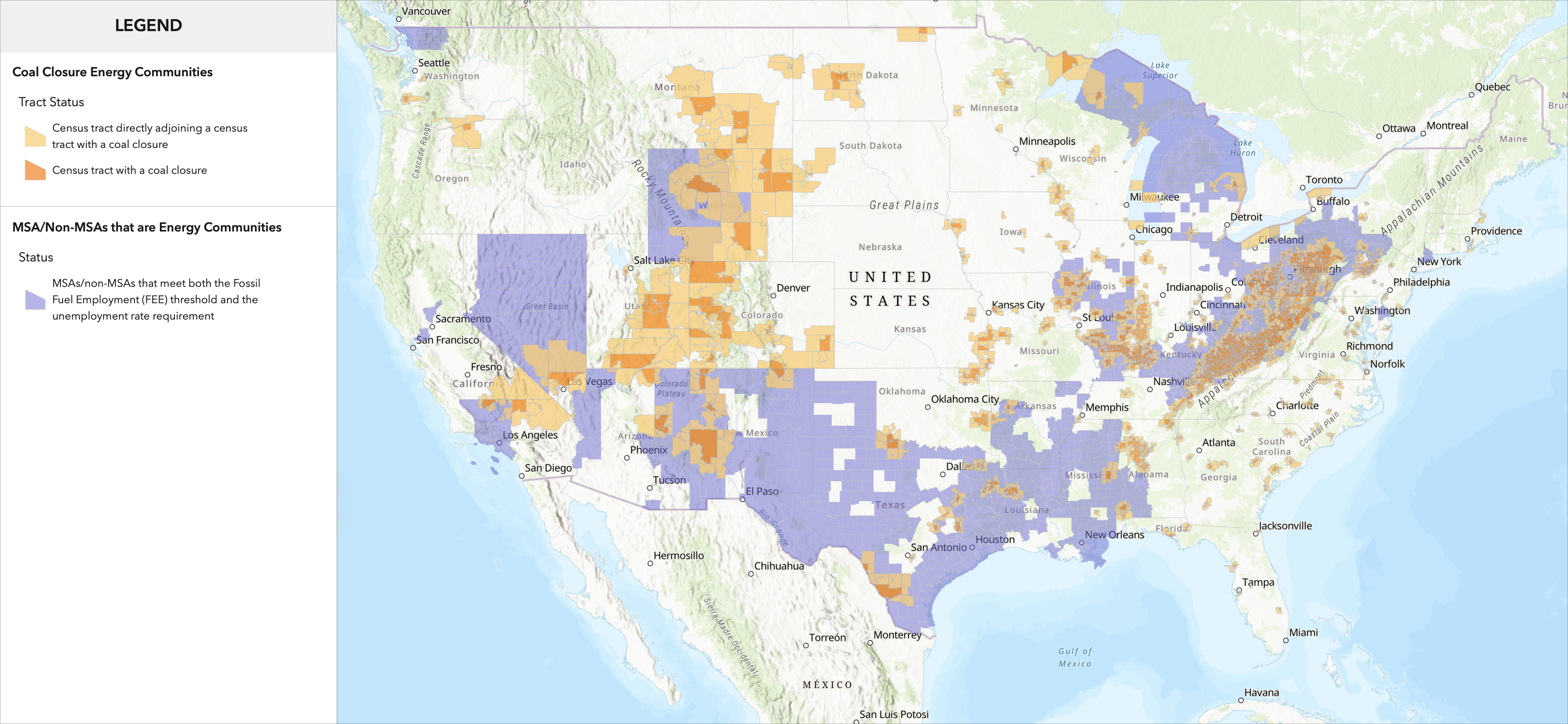

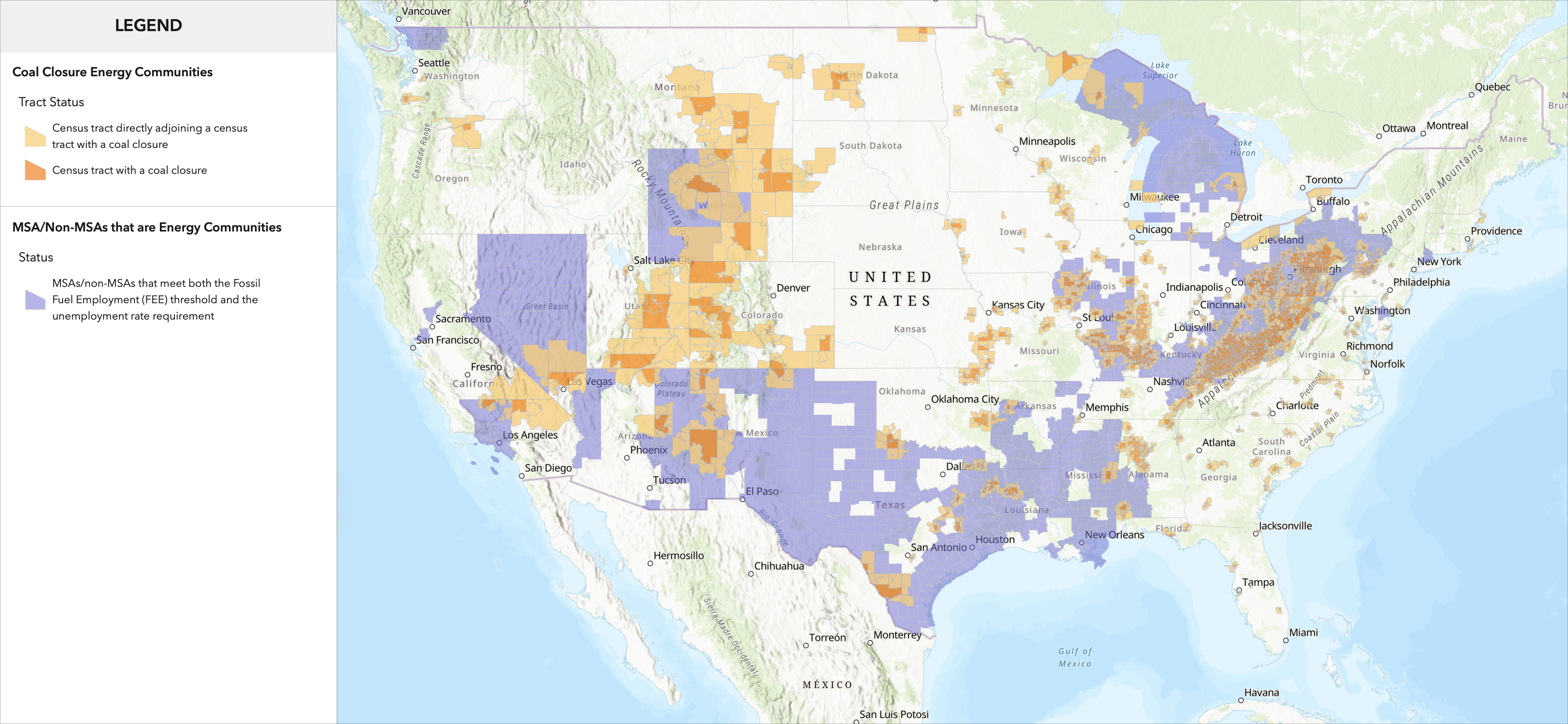

Next, the April guidance introduced a GIS interactive mapping tool to assist project developers in determining site eligibility for the other two energy communities categories: i) “coal closure” and ii) “fossil fuel employment”. This new tool makes it much easier to determine a site’s eligibility – try it out!

In June 2023, the Treasury Department and IRS issued additional follow-up guidance for the energy communities bonus adder. Most significantly, local unemployment rate data was updated to reflect 2022 data, and an additional clarification was provided for projects with nameplate capacities of less than 5 MW (AC) or less – these sites must not only have completed ASTEM E1527 Phase 1 ESAs, but a hazardous substance or pollutant must be detected on the site. Additionally, Treasury and IRS released a new Frequently Asked Questions page as an additional resource.

How to proceed from here

While we await additional guidance that determines whether specific sites would qualify for the energy communities bonus adder tax credit, there are some broad takeaways that will hold regardless.

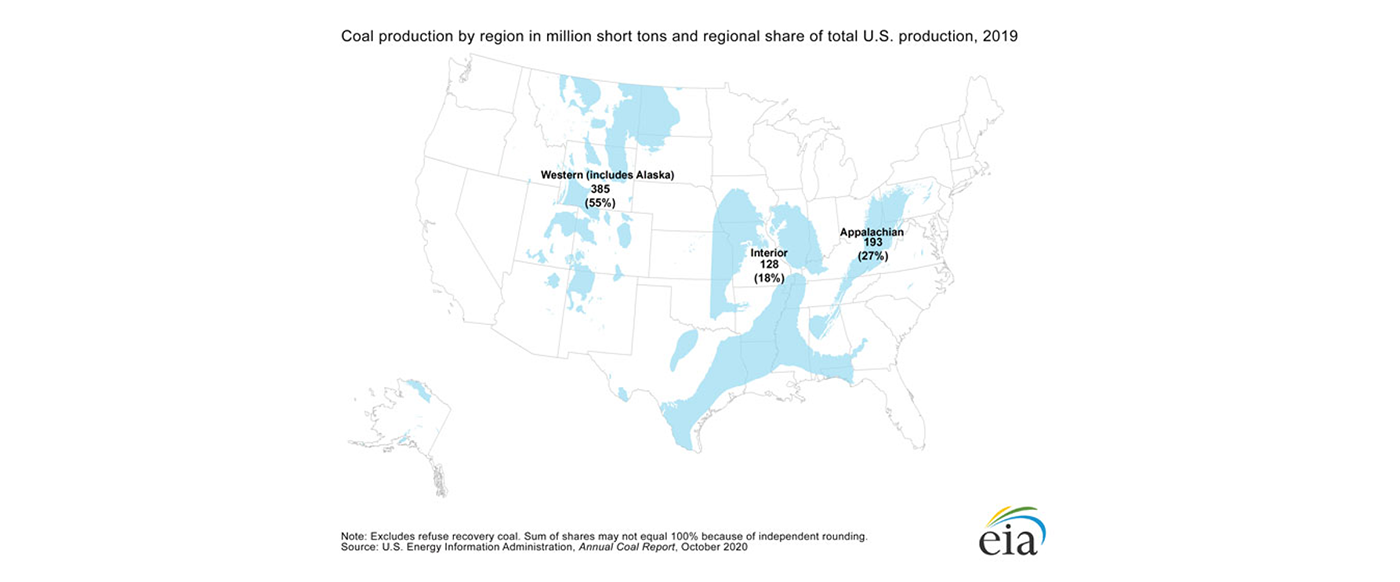

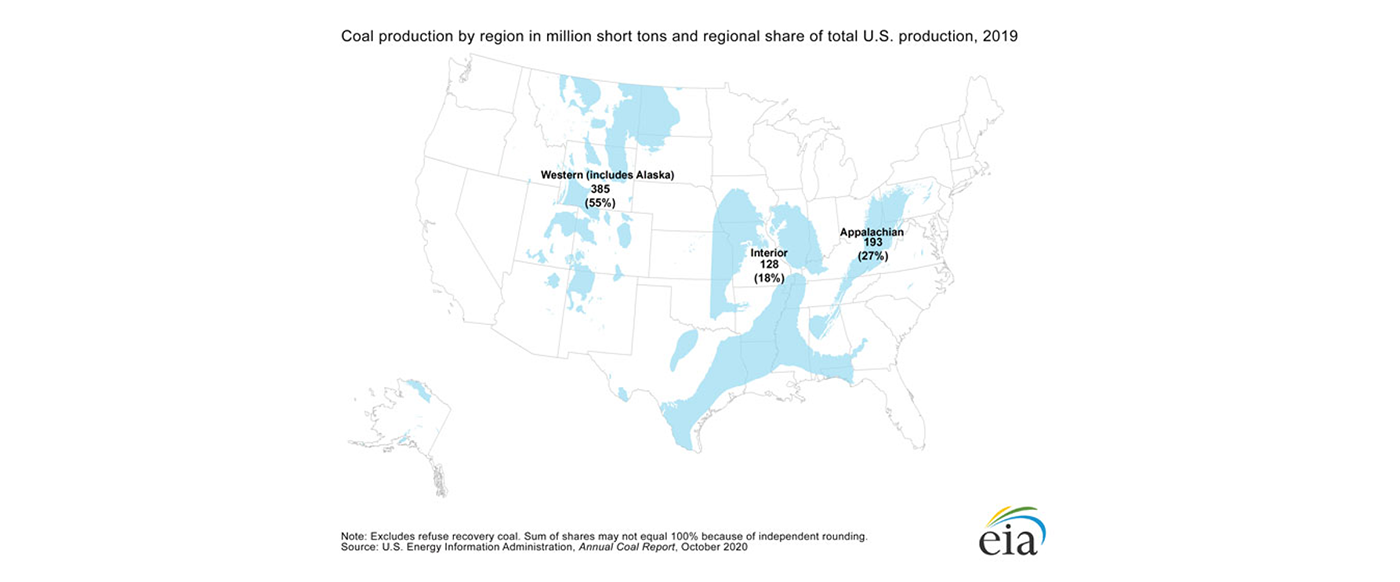

First, as expected, there is a large concentration of coal communities in the Appalachian, the Interior, and Western coal regions (see EIA map below). With another 46.1 GW of coal set to retire by 2029, more census tracts in these regions will be designated as “energy communities”, providing renewable energy projects there a 10% boost in their tax credits (EIA).

Figure 6: Map of coal-producing regions from the EIA

Second, because the geographical unit considered here is a census tract, traditionally designed to be an arbitrary area with a set number of people, this means more acreage of qualifying land will open in sparsely populated regions (West) than in densely populated regions (East). For energy storage projects, which have great siting flexibility, this means more development opportunities in the West, all else equal.

Multi-site organizations should keep these considerations in mind when looking to leverage the tax credits and their potential adders. Understanding the known and unknown of the incentives will help you get ahead of the interconnection and supply chain bottlenecks as we await the Treasury Department’s final guidance.

At Enel North America, we have a dedicated public policy team that is actively tracking and advocating for clean energy technologies. While the rules around the Inflation Reduction Act are evolving and we await final guidance from the Treasury Department, it’s important to start a conversation today so you are ready in advance of the final guidance. Our team of experts is ready to help you capture the most value from the Inflation Reduction Act. Reach out to us today to discuss the opportunities available to you – and how our integrated suite of on-site and off-site energy solutions can meet your specific energy requirements and sustainability goals. Reach out to us today.