By Maddie Lee

Maddie Lee is a Policy Analyst at Enel North America. She is responsible for facilitating the implementation of federal policies at Enel, such as the Inflation Reduction Act and the Infrastructure Investment and Jobs Act, across a wide range of technologies including renewable energy, green hydrogen, and EV charging infrastructure.

The passage of the Inflation Reduction Act (IRA) of 2022 heralds unprecedented levels of support for clean energy technologies in the United States. It directs nearly $400 billion in federal incentives to the development of new clean energy and energy technology projects – like solar photovoltaics (PV), battery energy storage systems, and more – to help reduce the nation’s carbon emissions through 2032. Beyond the monetary incentives, the longevity of the credits sends a strong signal indicating the stability of the market. An analysis by Princeton University’s REPEAT Project shows that the legislation will drive $4.1 trillion in cumulative capital investment in the United States energy supply infrastructure over the next decade.

Choosing between the ITC and the PTC

The majority of the $370 billion in energy and climate funding is realized through two types of tax credits, both working to reduce the project costs:

- The Investment Tax Credit (ITC) reduces upfront investment costs for a solar PV system or battery energy storage system that is installed during the tax year. Eligible costs include: the system itself (plus the balance-of-system equipment), installation costs, and interconnection costs for projects 5 MW or less.

- In contrast, the Production Tax Credit (PTC) generates tax credits per kilowatt-hour (kWh) of energy produced for the first 10 years of a facility’s operation. Whereas the ITC is a lump sum accrued in the year the project commences operations, the PTC is an annual sum that varies according to the facility’s performance.

For the first time since 2006, solar PV systems are eligible for the PTC – wind projects have enjoyed this tax credit for decades. The ITC and the PTC cannot be leveraged in combination for a project therefore it is necessary to have an in-depth understanding of the two tax credits – and how they change in value according to a project’s expected costs and performance – to decide which tax credit will unlock the greatest benefits. In general, renewable energy projects will receive more value if they opt for the PTC in sunny and windy areas (with greater energy generation potential), and the ITC in areas that are less resource-rich or that incur higher installation costs. Enel North America can help you evaluate your optimal choice on a case-by-case basis to ensure you receive the most value from these tax credits.

Standalone energy storage ITC at last

A long-awaited win in the Inflation Reduction Act of 2022 is the new eligibility of standalone energy storage for the ITC. Energy storage is critical to today’s grid infrastructure – large amounts of the country’s fossil fuel capacity are being replaced with intermittent resources like solar and wind, presenting balancing challenges for the grid. The ability to store energy for later use provides real-time balancing of supply and demand to help ensure grid reliability.

Previously, standalone energy storage systems had to be attached to a solar PV or wind system to be eligible for the upfront investment incentives, and they had to charge from that system 75% of the time. Now that standalone energy storage qualifies for the ITC, these requirements are no longer necessary to qualify for the incentive. This gives energy storage projects like lithium-ion batteries more siting and operational flexibility, as well as the ability to capture additional value streams like energy arbitrage, ancillary services, grid stability services, and more. Enel North America’s sophisticated modeling approach and extensive energy markets expertise can help you evaluate the full scope of benefits of your battery energy storage systems.

Transitioning to technology-neutral credits, and their eventual phaseout

The Inflation Reduction Act of 2022 introduced technology-neutral tax credits (for both the ITC and the PTC) to replace the solar PV, wind, geothermal and energy storage incentives for projects commencing service after 2024. These credits can be applied to any energy-producing technology if their greenhouse gas (GHG) emissions are net-zero. While we await guidance around carbon capture technologies and their eligibility, the general understanding is that solar PV, wind, geothermal and battery energy storage will be treated as having net-zero emissions.

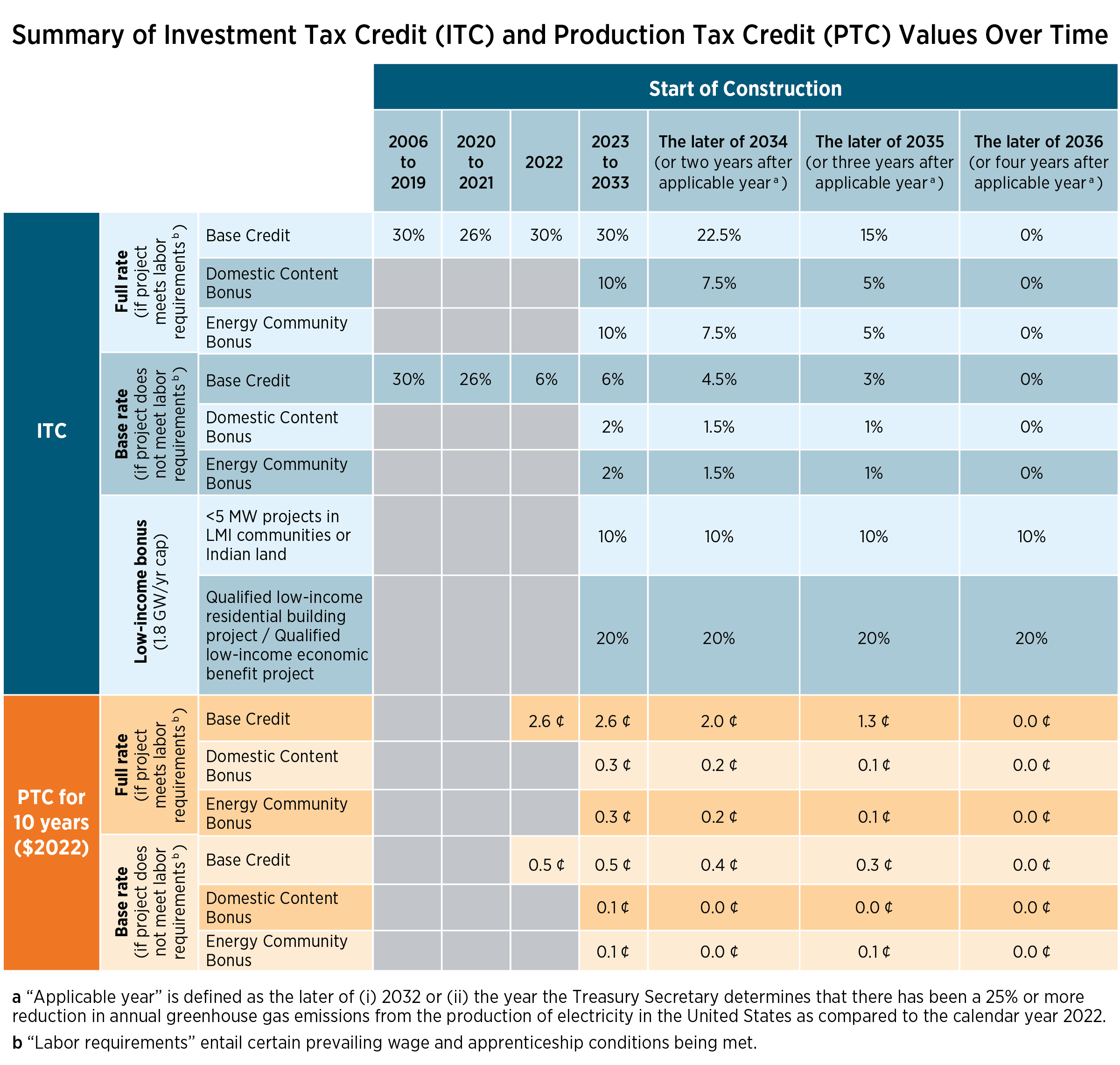

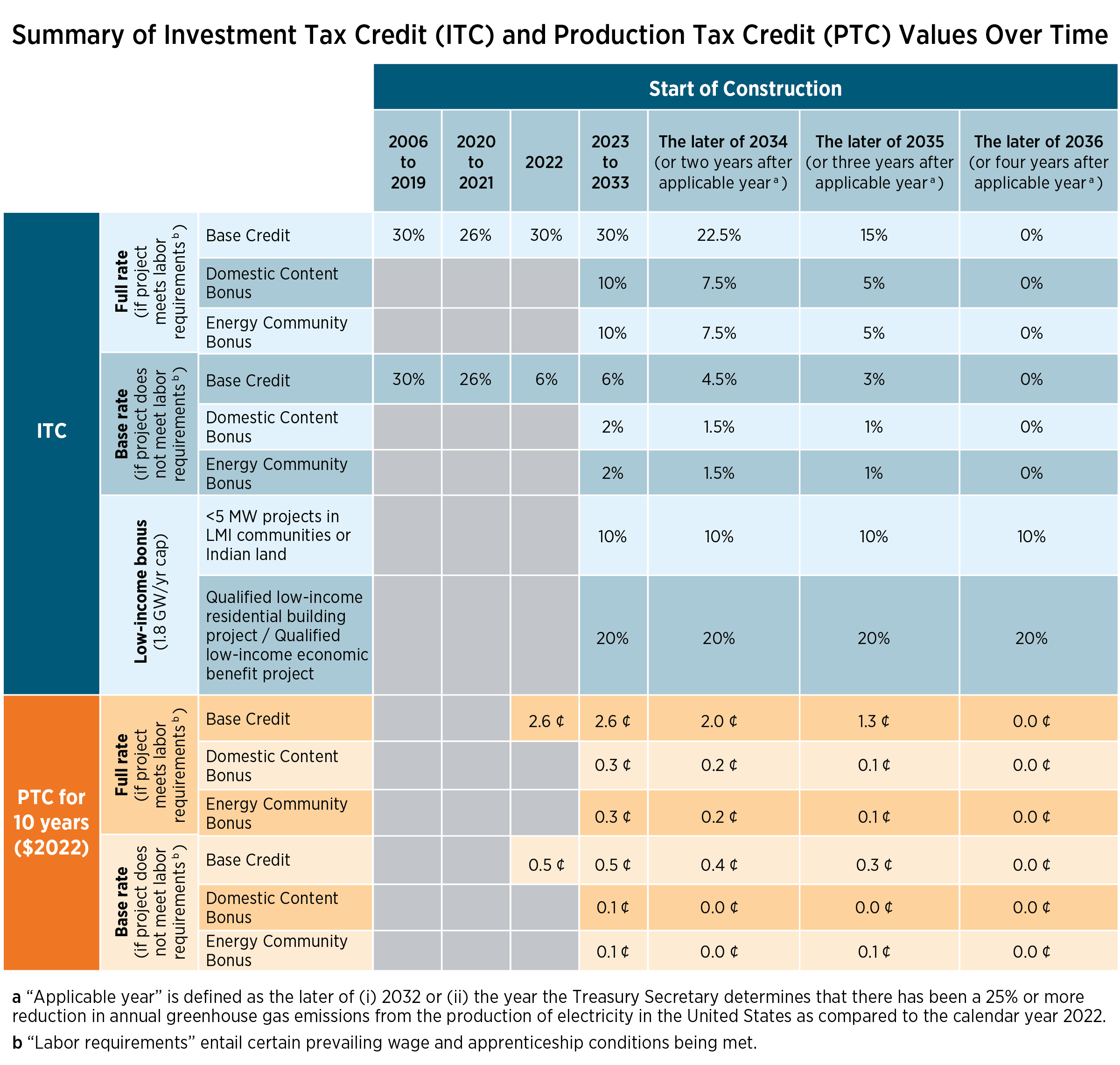

The ITC, PTC, and associated bonuses will phase out in the later of 2032 or when the Treasury Secretary determines that there has been a 75% or more reduction in annual GHG emissions from electricity production in the United States, relative to 2022. This means that zero-emission energy systems that commence service in 2022 or later are eligible for a full rate of 30% ITC or a 2.6 ¢/kWh PTC, when prevailing wage and apprenticeship requirements are met – conditions put in place to build a stronger domestic energy talent pipeline. Projects that begin construction after 2033 (or the phaseout year) will receive 75% of the value in 2034, 50% in 2035, and 0% thereafter. Refer to the table below for more information from the Department of Energy (DOE).

Source: DOE, “Federal Solar Tax Credits for Businesses’’ (2022)

Incentives across clean energy, transport, and manufacturing

Beyond solar PV, wind, geothermal and energy storage, the Inflation Reduction Act of 2022 also covers many other technologies and industries that are primed for exponential growth. For the clean energy sector, the Inflation Reduction Act introduces a new clean hydrogen PTC, adds a new production tax credit for clean energy manufacturing, and extends the existing ITC for advanced energy projects. The Inflation Reduction Act also expands the existing clean vehicle credit, which benefits new electric vehicle (EV) buyers, after modifying certain eligibility requirements, as well as creates several other new EV-related tax credits. Download our summary document to view a list of select incentives and their eligibility requirements.

Strings attached: unlocking the full credit

Many of the Inflation Reduction Act of 2022’s incentives are structured as a tiered credit system, including the renewable energy PTC and ITC. At the minimum, project owners are eligible for a base rate (a 6% ITC, 0.5 ¢/kWh PTC), but if they meet the prevailing wage and apprenticeship requirements, the project owner is eligible for a full credit (a 30% ITC, 2.6 ¢/kWh PTC). The PTC shown is in 2022 dollars and will be adjusted annually for inflation.

Bonus credits also available

Projects may also earn bonus tax credits if they meet additional eligibility requirements. A 10% bonus boost is allocated to projects that:

- Meet a “domestic content” requirement (all steel or iron must be produced in the United States and a required percentage of the total costs of manufactured products needs to be mined, produced, or manufactured domestically) or

- Are located in “energy communities” (a brownfield site, an area significantly impacted by the transition away from fossil fuels, or a census tract in which a coal mine closed or a coal plant retired after a specific year).

- If projects are located in “low-income communities” (low-income community or on tribal land), there will be a new, separate, but finite pool of tax credits available each year that applicants can apply and compete for an award.

Stacking these bonus adders together means a project – given that it fits all eligibility criteria and is accepted to receive the low-income adders – could achieve a maximum 70% ITC. Learn about the nuances of achieving these bonus adders. Enel North America can help you identify the most lucrative projects in your portfolio and unlock the maximum benefits from the Inflation Reduction Act.

Next steps

The Inflation Reduction Act of 2022 contains upwards of hundreds of billions in incentives for organizations across the United States to catalyze private investments in clean energy, transport, and manufacturing. As we await additional guidance from the Treasury Department on certain provisions, organizations need to lay down the groundwork now to take advantage of the sizeable federal tax credits. Acting now allows you to create an early mover advantage and mitigate the supply chain and interconnection application bottlenecks expected to emerge in the clean energy infrastructure industry. Our team of experts at Enel North America are ready to help you capture the most value from the Inflation Reduction Act. Contact us today to evaluate your facilities for on-site energy solutions that meet your specific energy requirements and sustainability goals. Contact us today.