By Maddie Lee

Maddie Lee is a Policy Analyst at Enel North America. She is educating Enel’s various businesses about the opportunities created by the Inflation Reduction Act and the Infrastructure Investment and Jobs Act, across a wide range of technologies including renewable energy, green hydrogen, and EV charging infrastructure.

The Inflation Reduction Act of 2022 directs $370 billion toward incentivizing the implementation of clean energy technologies to reduce carbon emissions. And this money is not just for corporations and government entities – the Inflation Reduction Act also contains incentives for individual households (also, multi-family or rental housing building owners, thereafter termed “consumers”). For corporations, this means your employees and your contractors. For cities and municipalities, this means your residents and your constituents. Whether these end-use consumers are looking to make their homes more energy efficient, upgrade to a new HVAC system, harvest renewable energy by installing a rooftop solar photovoltaic (PV) system, or replace their gasoline car with an electric vehicle, there are various federal tax credits and rebates they can leverage.

In this guide, we mainly focus on how you, as a consumer, can start planning now to save money via home energy rebates in the future. While the cashback rebates are not yet available (as of February 2023), the federal government will be working with the states and tribes over the next few months on the best way to roll out these rebates to consumers. We recommend that you start familiarizing yourself with the program eligibility and requirements now, so that you can take advantage of these opportunities as soon as the final guidance is issued. In the meantime, you can already get a head start on clean energy purchases (like solar PV panels, electric vehicles, and electric vehicle chargers), whose benefits are disbursed through tax credits that you can claim on your future tax return(s).

Energy efficiency and HVAC equipment upgrades

Energy efficiency is a demand-side strategy to reduce your overall energy consumption. By investing in energy efficiency retrofits like lighting and insulation upgrades, or new, more efficient equipment, consumers can reduce the overall amount of energy they use while experiencing the same performance and level of comfort as before.

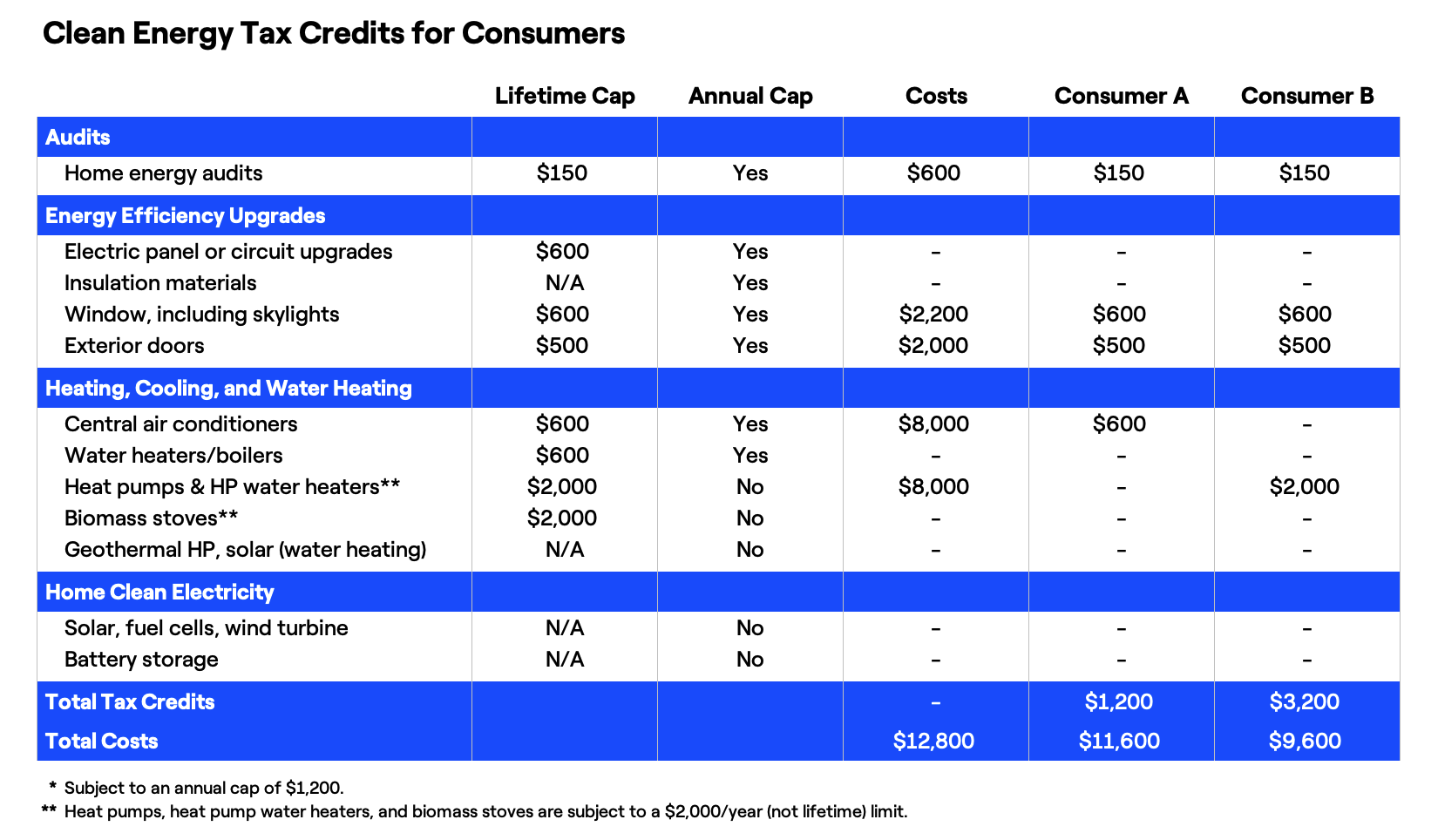

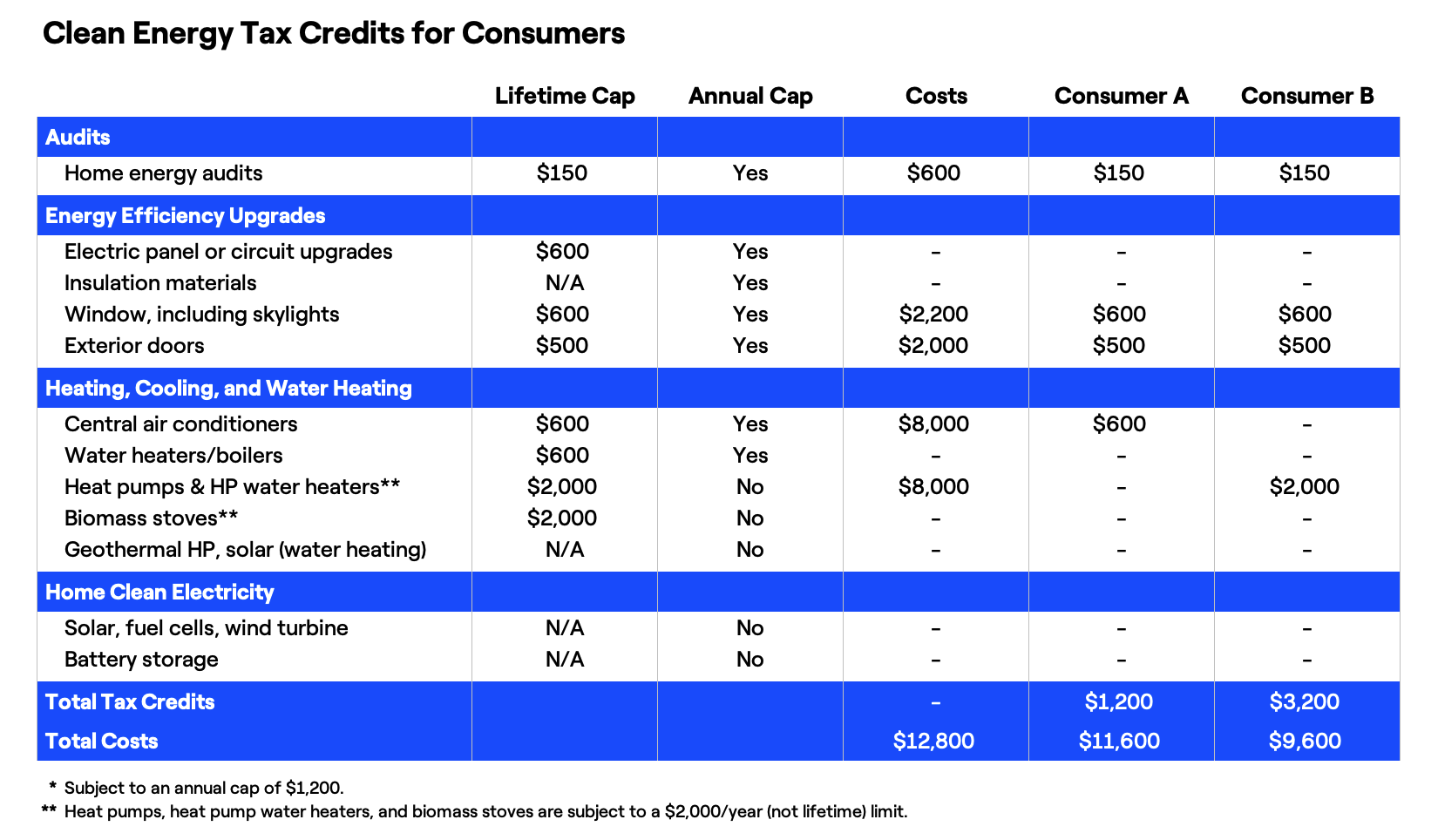

Previously, Section 25C of the Internal Revenue Code, which covers energy efficiency home improvement tax credits, had a lifetime cap of $500 per taxpayer. The Inflation Reduction Act increases the existing 10% tax credit to 30% for qualifying home energy efficiency goods, while also increasing the annual cap to $1,200 per taxpayer. To make the most use of these incentives, here are some examples of energy efficiency goods:

- Home energy audit: A recommended first step is to hire an energy expert to assess your home’s energy efficiency performance and recommend a plan for energy efficiency and HVAC improvements. This assessment can help determine the best use of the available tax credits, rebates, and, more importantly, your budget. Assuming a $600 home energy audit, a 30% tax credit means $150 back in your pocket.

- Energy efficiency upgrades: Make your home more energy efficient. Eligible weatherization projects include installing better insulation materials, air sealing, ventilation improvements, upgraded windows (including skylights), and exterior doors. There’s a 30% tax credit for up to $250 per door (for a maximum of $500) and up to $600 for window upgrades. You might also need to upgrade your home’s electrical panel – sometimes called a breaker box, after buying a more efficient appliance or EV charger. If you do, there’s a 30% tax credit (capped at $600) for that too. While installing an upgraded electrical panel won’t save you money directly, it will enable you to make other purchases that will, like installing a heat pump or an electric vehicle charger.

- HVAC upgrades: Another way to reduce your overall energy usage is to upgrade your heating and cooling equipment. Eligible products include central air conditioners, water heaters and boilers, heat pumps and heat pump water heaters, biomass stoves, and geothermal heating or solar water heating equipment. More traditional HVAC systems like air conditioners and water heaters/boilers have a cap of $600, while heat pumps and biomass stoves have a higher cap of $2,000.

Electric heat pumps, which heat homes and water far more efficiently than fossil-fuel appliances or older electric resistance machines, appear to be the best bang for your buck because they have a higher cap at $2,000. In other words, with everything else the same, Consumer A who opts for a $8,000+ heat pump will save more than Consumer B who opts for a more efficient $8,000+ central air conditioning system. This can be seen in the illustrative example below.

Ok, so what exactly is a heat pump?

And how does a heat pump differ from a traditional HVAC system? A heat pump can be used to replace both your traditional air conditioner and home heating system (like a boiler or furnace). Heat pumps use electricity to transfer heat from a cool space to a warm space (like an air conditioner), and from a warm space to a cold space (like a heating system). In the warmer months, a heat pump pulls heat from the inside of your home and pushes it outside. In the colder months, it does the opposite, collecting heat from the outdoor air and pulling it indoors. Because heat pumps transfer heat rather than generate it, they require less energy to operate than a traditional HVAC system (about 3-5 times more efficient than traditional fossil fuel heating systems). This increased efficiency translates into hundreds of dollars per year in savings.

Historically, heat pumps have had higher adoption rates in regions with mild winters, like Texas and Florida. However, in particularly cold climates, like the Northeast, adoption was not so great. That’s changed. There’s been dramatic performance improvements in heat pump technology in recent years, with many models now capable of delivering plenty of heat even when outdoor temperatures drop as low as -15°F (-26°C).

Assuming that heat pumps are technically feasible in your area, here’s how they offer more value than their non-electric counterparts.