By Duncan Cooper

Duncan Cooper is the Procurement Market Strategy Director at Enel North America. He helps guide the company’s North American procurement strategy by providing analysis of market conditions and evaluating the effects of new policies and regulations. He has over 13 years’ experience in the renewable energy industry.

The U.S. Department of the Treasury has recently released a notice of intent (NOI) to propose regulations for the Inflation Reduction Act’s domestic content bonus tax credit, which is expected to have significant implications for the energy industry. The bonus tax credit aims to incentivize U.S. manufacturing and strengthen America's clean energy supply chains by rewarding project developers who use a specified amount of domestic content in their clean energy projects.

In this blog post, we will delve into the essential aspects of this bonus tax credit and examine its impact on renewable energy developers and clean technology manufacturers.

What is the domestic content bonus tax credit?

The domestic content bonus tax credit was created by the Inflation Reduction Act, which directs nearly $400 billion in federal incentives to the development of new clean energy and energy technology projects such as solar photovoltaic (PV), wind, geothermal and battery storage.

Most of the funding in the Inflation Reduction Act is offered through two types of tax credits: the Investment Tax Credit (ITC) and the Production Tax Credit (PTC). The ITC reduces upfront investment costs for a project like a solar PV system or a battery storage project that is installed during the tax year. In contrast, the PTC generates tax credits per kilowatt-hour of energy produced for the first 10 years of the project’s operation.

Beyond these incentives, the Inflation Reduction Act offers bonus tax credits for projects that meet additional requirements. The domestic content bonus tax credit is one of these bonus credits. Renewable energy projects and energy storage projects that meet certain domestic content requirements allow project owners to qualify for a “bonus credit amount” worth up to an additional 10% of qualifying costs for the ITC or an additional 10% for the PTC (i.e., 110% of the “full” rate), which can translate into millions of dollars in additional tax credits.

How does the domestic content bonus tax credit work?

Projects eligible for both the ITC and PTC are entitled to a base tax credit rate. However, to qualify for the “full” base tax credit rate (30% ITC or a $0.0275/kWh PTC (2023 value)), they must satisfy prevailing wage and apprenticeship criteria. Projects may then earn bonus tax credits by fulfilling additional eligibility requirements.

The domestic content bonus tax credit requirements are applied in conjunction with satisfying the original ITC/PTC requirements. If the project meets the ITC/PTC wage/apprenticeship requirements, and then also satisfies the domestic content requirements, the project is eligible for the full 10% bonus tax credit. However, if the ITC/PTC wage/apprenticeship requirements are not met, the value of the domestic content bonus tax credit diminishes significantly (dropping from 10% to around 2% in the case of ITC).

What’s in the Treasury’s guidance on domestic content?

The U.S. Department of the Treasury released a NOI to propose regulations. The guidance includes the initial rules for wind, solar, and energy storage projects. It is the first step in the rulemaking process and is intended to provide near-term certainty for the industry. To this end, the notice includes a safe harbor provision, which allows renewable energy projects and energy storage projects to claim the domestic content bonus tax credit if they started construction before the day that is 90 days after the proposed regulations are published in the Federal Register.

How are the domestic content requirements broken down?

The definition of what constitutes domestic content is complicated, but below we list the two most important criteria. To qualify for the domestic content bonus tax credit, a solar, onshore wind, or storage project must meet these two criteria:

1. The project must use 100% domestic steel and iron for construction materials that are structural in nature.

This first requirement means that for structural iron and steel, each item must be 100% manufactured in the U.S., including all processes down to the smelting of the crude steel. For example, utility-scale racking, ground screws and foundation rebar will have to comply with this requirement. However, nuts, bolts, and screws – as they are not structural in function – do not need to comply.

2. Projects that begin construction before 2025 must use at least 40% domestically manufactured products.

The second requirement is even more complex. For projects to comply with this requirement, at least 40% the manufactured products in a project must use domestic content. There are two types of products that are evaluated: U.S. manufactured products and non-U.S. manufactured products.

In the notice, manufactured products are further broken down using a list of product components to be considered. Only these products and product components are evaluated when calculating a project’s domestic content percentage. It’s important to note that the 40% domestic content requirement increases 5 percentage points annually for projects that begin in 2025, 2026, and 2027, maxing out at 55%.

Here is what the calculation looks like:

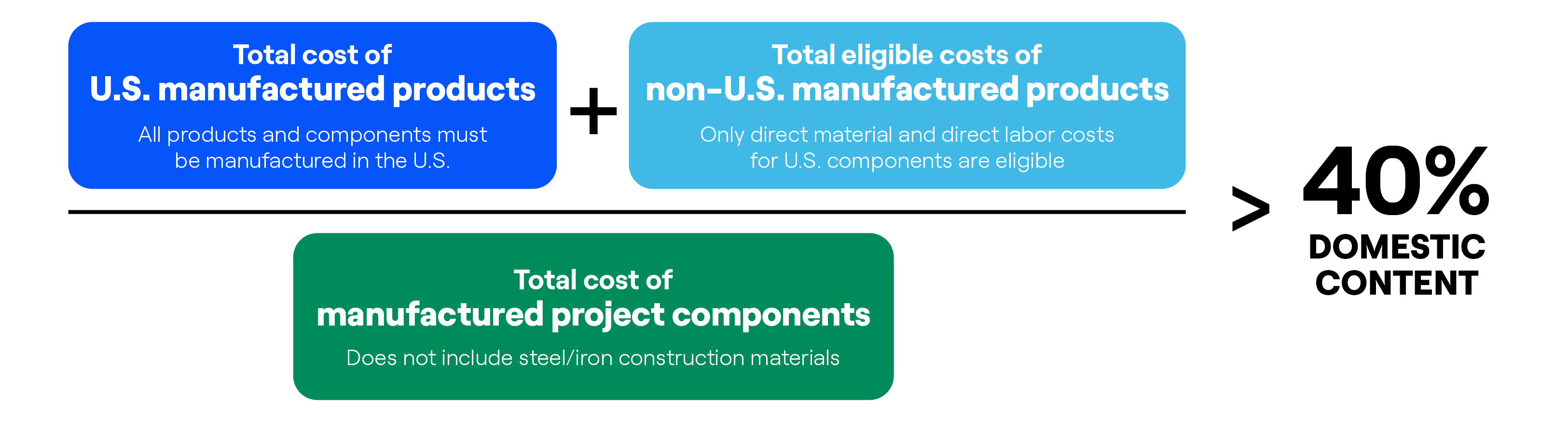

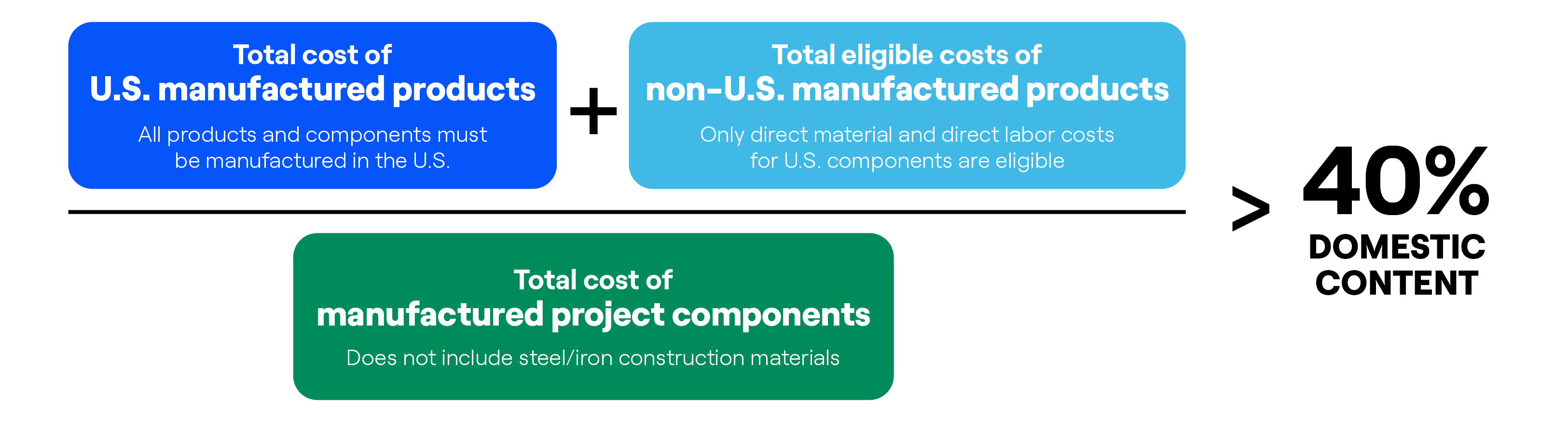

Calculating the 40% domestic content requirement: The numerator will include all costs of all U.S. manufactured products and their components, as well as the sum of eligible costs of non-U.S. manufactured products (i.e., the direct materials and labor costs for U.S. components). The denominator will have the sum of the cost of all manufactured project components, excluding the steel/iron construction materials.

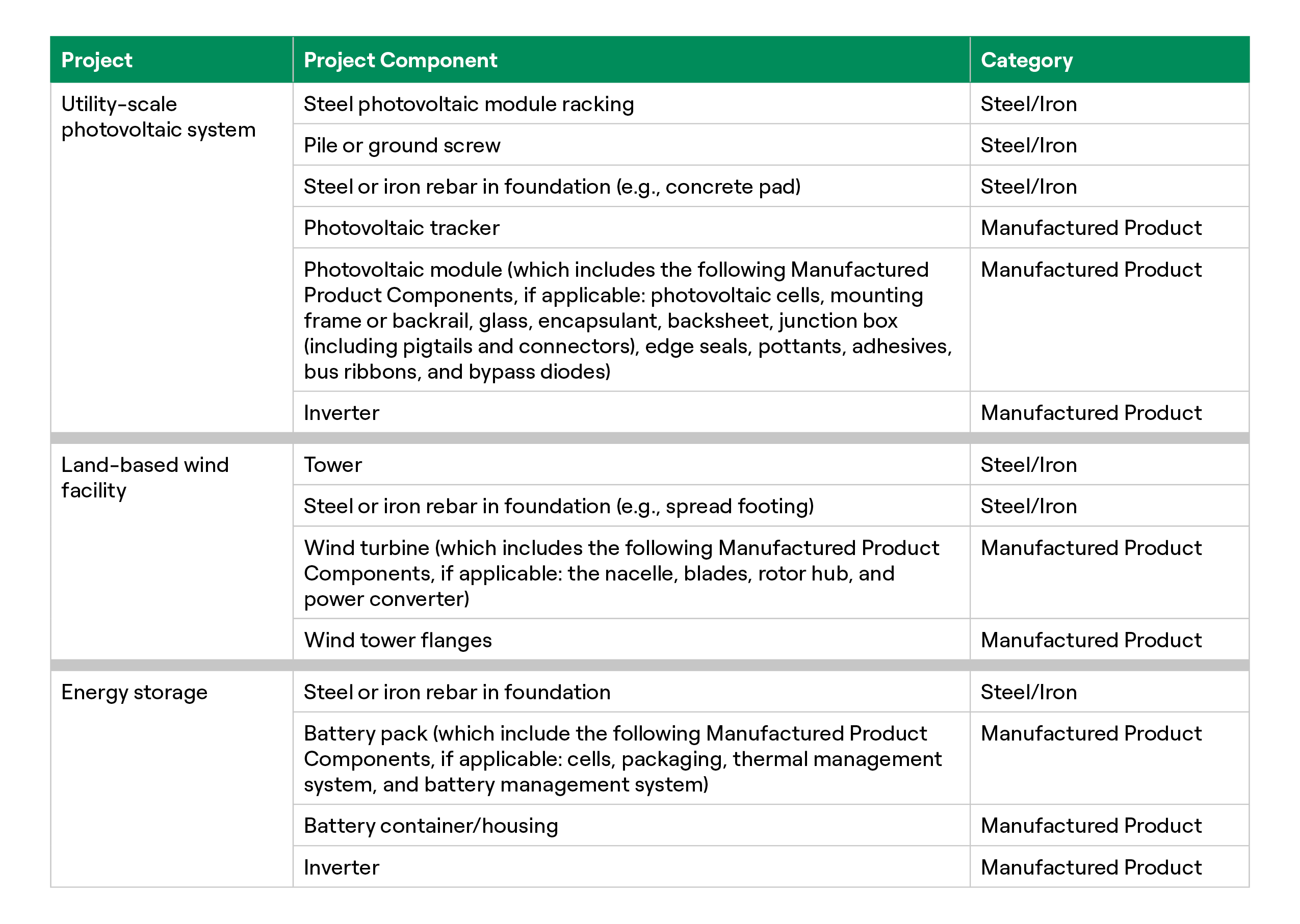

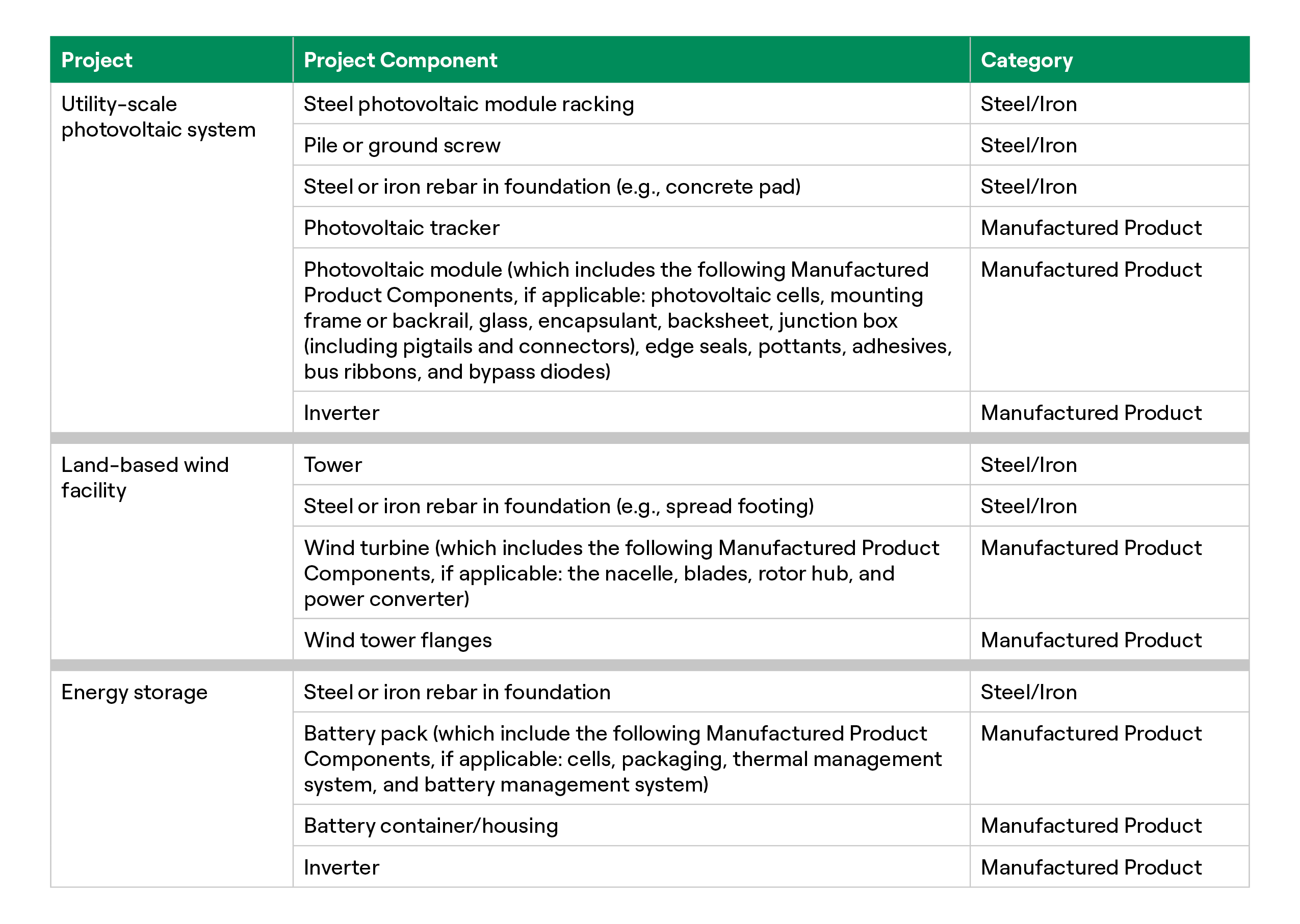

The Treasury notice provides an initial, but non-exhaustive list of steel/iron products, manufactured products, and product components that decision-makers may rely on for calculating a project’s domestic content percentage.

Initial list of applicable project components

The tables included within the Notice provide a helpful list of products and product components, but it is worth emphasizing that these lists are not an exhaustive set of all applicable project components for such facilities. Also, component lists may differ between the ITC and PTC. To address this uncertainty, the clean energy industry is asking the Treasury to finalize a list of products and components that must be considered for each project type.

In addition, the latest guidance lacks details about rooftop solar components, leaving the industry seeking more information. We anticipate additional guidance from the U.S. Treasury soon and will promptly update this post once it is released.

Lastly, and unlike other Inflation Reduction Act tax credits, to claim the domestic content bonus tax credit, the developer is required to submit a statement to the Internal Revenue Service (IRS) for each relevant project, certifying that the steel/iron and manufactured product components were produced in the U.S.

How will the domestic content requirements impact clean energy projects moving forward?

While the domestic content bonus tax credit will be instrumental in boosting domestic production and supply chains, meeting domestic content requirements will be challenging in the early years, with a few exceptions. Project developers need to actively seek and prioritize U.S. manufactured products and components to have a positive impact on the domestic supply chain. It will take time for domestic manufacturers to ramp up their manufacturing capabilities – as they gradually offer and certify domestically manufactured products, demonstrating compliance should become easier.

The rising prices of components are a concern for renewable energy project developers who are considering leveraging the domestic content credit. There is a possibility that domestic manufacturers of renewable energy technologies may charge higher prices for their products. The increased costs associated with meeting eligibility requirements could outweigh the economic benefits of the bonus tax credit. Calculations indicate that it may be beneficial for some developers, but not all, to purchase more expensive components in order to qualify for the domestic content bonus tax credit. At least for now, analysis of the cost of meeting the domestic content requirements needs to be performed on a project-by-project basis to make sure the optimal strategy is pursued.

Organizations are working hard to understand the risks and potential rewards of complying with the domestic content requirements. Those with well-established supply chains are engaging in conversations with their trusted partners to negotiate mutually advantageous agreements and augmenting their legacy supply chains with new suppliers where necessary.

Organizations starting from scratch and establishing their supply chains today have a different challenge, but perhaps an advantage. They are building their supply chains with the domestic content bonus tax credit compliance in mind, potentially paving the way for more competitive pricing and greater flexibility to meet the domestic content requirements.

When will we know more?

The recently released U.S. Department of the Treasury NOI does not provide a final set of rules, nor a deadline for releasing them. The final requirements, expected to come out in 2024, will serve as the definitive final set of guidance.

The initial guidance emphasizes the importance of collaboration among renewable energy developers and equipment manufacturers. Organizations will have to work closely with their suppliers to share manufacturing and pricing information, which will drive progress and allow them to take advantage of the domestic content bonus tax credit.

In the meantime, projects can rely on the initial guidance within the notice – but be aware that some uncertainty remains. Determining if a project meets the domestic content requirements is challenging. If you are looking to deploy a clean energy project, it is essential to work with an energy partner who thoroughly understands the requirements and can help your organization maximize your PTC or ITC value. Your energy partner can help you evaluate your options.

What’s next?

The Inflation Reduction Act of 2022 presents valuable opportunities for organizations in the United States to support domestic manufacturing and nurture clean energy supply chains while advancing their own energy strategies. However, understanding the requirements – particularly in the case of the domestic content bonus tax credit – can be complex, making it challenging for organizations to determine how to leverage this incentive. While we await the final rules from the U.S. Department of the Treasury, it is crucial to initiate discussions today to ensure preparedness for the forthcoming final guidance.

At Enel North America, our experts are prepared to help you unlock the maximum value of the domestic content bonus tax credit and other incentives offered by the Inflation Reduction Act. Contact us now to explore the opportunities available to you and discover how our portfolio of on-site and off-site energy solutions can meet your energy needs and sustainability goals.