Discover the promise of virtual power plants

Download our eBook to find out how VPPs contribute to grid stability while improving your bottom line – and how opportunities for VPPs will continue to increase.

06 14, 2023

{{ content.description }}

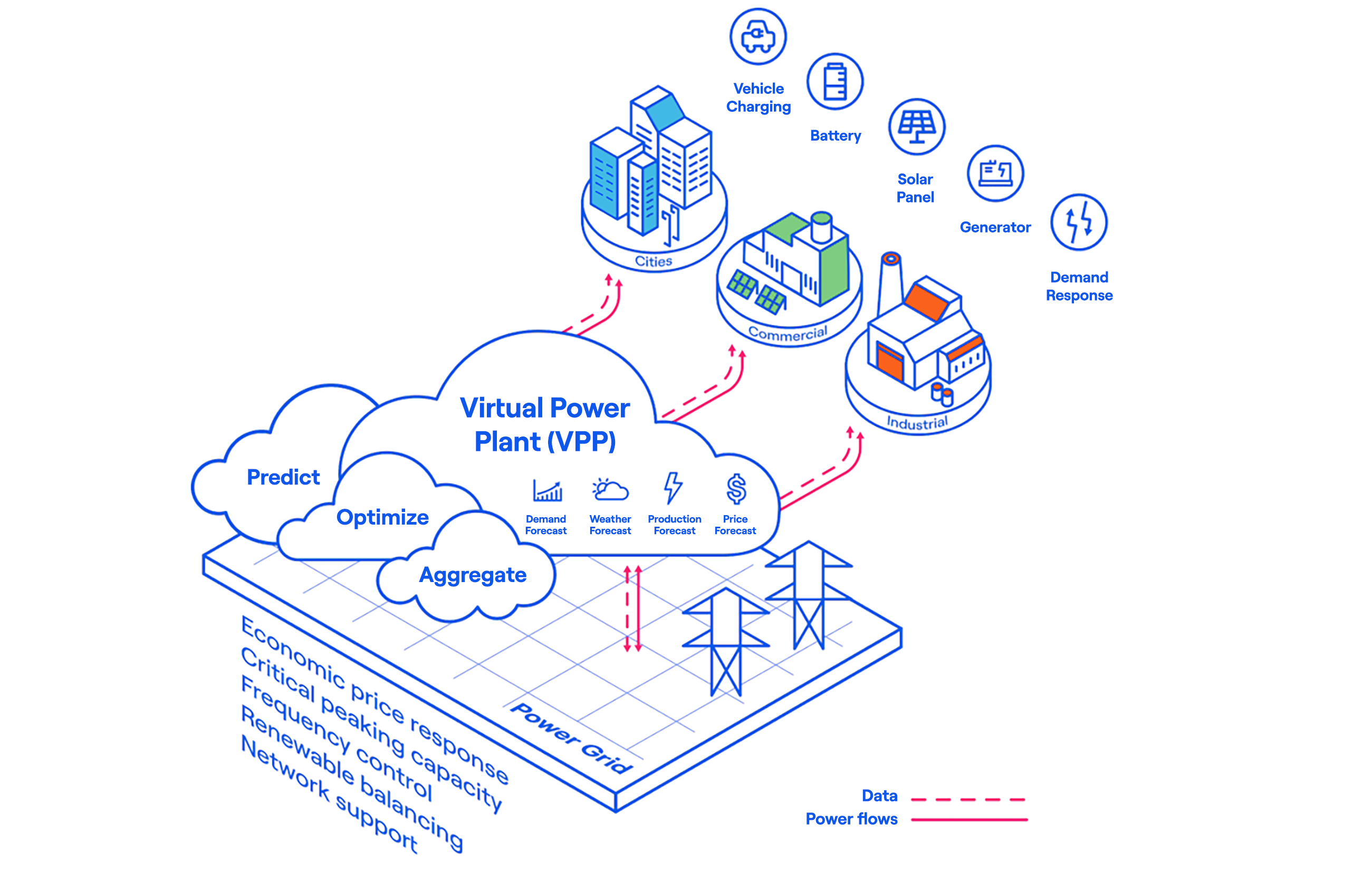

A virtual power plant (VPP) is a decentralized portfolio of distributed energy resources (DERs) and other assets that can be aggregated and operated as a larger scale asset in response to external factors – such as requests from grid operators or price signals like time-of-use rates. Adoption of DERs is growing, as they enable organizations to be more flexible in how they consume energy, advance their sustainability goals, and boost resilience across their operations. A wide variety of DERs and assets can be aggregated into a VPP, including:

VPPs can leverage and aggregate DERs to address grid challenges. For example, VPPs can be helpful in addressing energy supply shortages during times of peak demand by using flexible capacity to help reduce demand during system peak hours. They can also improve real-time balancing of supply and demand on the grid by providing energy flexibility and ancillary services – energy can be focused on essential loads and shifted away from non-essential tasks, enabling more resilient communities.

For practical purposes, VPPs act like and have the same effect as a traditional, centralized large power plant. Their ultimate goals are the same – ensuring that energy demand on the grid is met instantaneously by the available energy supply and that the grid remains stable. But they achieve this in significantly different ways than traditional power plants. Traditional power plants operate out of one physical location and work only on the supply side of the grid equation – as demand increases, the centralized physical power plants ramp up to supply more energy.

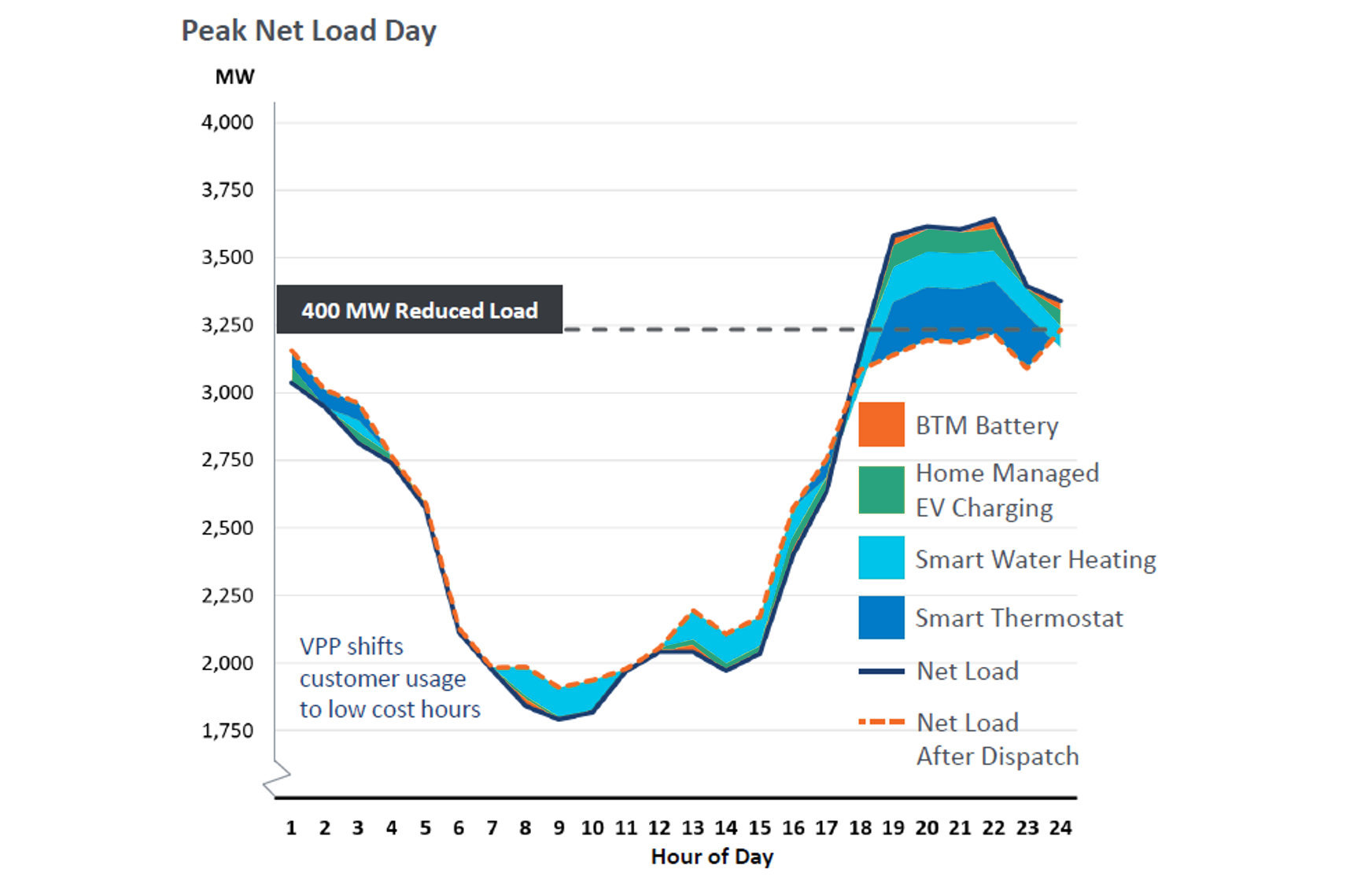

A VPP, by contrast, orchestrates the many decentralized assets within its portfolio to help supply meet demand, most often by lowering the overall combined demand of those assets. This turns out to be incredibly useful to the grid, because decreasing demand has the same effect as a peaker plant increasing supply – ensuring that supply and demand stay balanced. By virtue of leveraging DERs, VPPs offer many benefits over the traditional model. This is because the alternative, peaker plants, are often expensive to operate. In addition, grid operators spend a lot of money maintaining these plants so they can be ready to quickly start up at times of peak demand. They are also highly polluting. DERs in a virtual power plant, by contrast, have much lower marginal costs and are typically using much cleaner energy – like on-site solar, storage, or controllable load.

The image above from Real Reliability: The Value of Virtual Power, provides a visual demonstration of how VPPs provide flexibility as an alternative to peaker plant power generation. During the peak demand times of 6PM–12AM, the net load reduction offered by the different assets in a VPP (i.e., batteries, managed EV charging, and smart appliances like water heaters and thermostats) would otherwise have to be served by a high-polluting peaker plant.

There’s also another factor to consider. As peaker plants age and extreme weather events increase in intensity and duration, VPPs may be a more reliable resource than fuel-constrained systems for grid support. In last year’s Winter Storm Elliott, for instance, there were widespread capacity shortages in the PJM Interconnection, a regional transmission organization that serves all or parts of 13 different states in the Mid-Atlantic United States. PJM found that gas-fired power plants accounted for 63% of the unplanned outages, and coal-fired generators made up 28% of the outages on a MWh basis. PJM noted that “a lack of fuel supply was the largest single cause of the outages at the gas-fired power plants, followed by freezing equipment.” In contrast, VPPs helped to avert what could have been an even larger disaster, with aggregated demand response performing well during the extreme weather.

At the most basic economic level, organizations that participate in VPPs can decrease energy spend and earn new revenues by participating in grid programs.

Organizations that don’t have any storage or generation assets may still be paid because they are offering flexibility to the grid by temporarily reducing their energy use or shifting it away from times of peak demand, and they will be doing this at times when it is most valuable. As a result, they receive new revenue from utilities or grid operators based on their level of energy reduction. They are compensated for contributing much needed energy flexibility to an energy grid that is increasingly pushed to its limit.

But the value of VPPs goes further than just these direct economic benefits. VPPs are a growing contributor to local energy stability as the energy transition progresses. Participants are helping to keep energy reliable in their communities.

It’s important to note that today, participating in a VPP with DERs requires a site to be integrated with the grid to monetize their assets. However, the growing integration of DERs can create challenges for both organizations and grid operators. For an aging grid that was not initially designed with DERs in mind, rapidly integrating DERs can disrupt electrical frequencies and create voltage issues. As a result, VPP participation is only possible in certain states and regions based on local regulations. Organizations need an energy partner with energy market expertise across the country, like Enel, to help them navigate this landscape and unlock all available value streams.